__________________________________________

__________________________________________

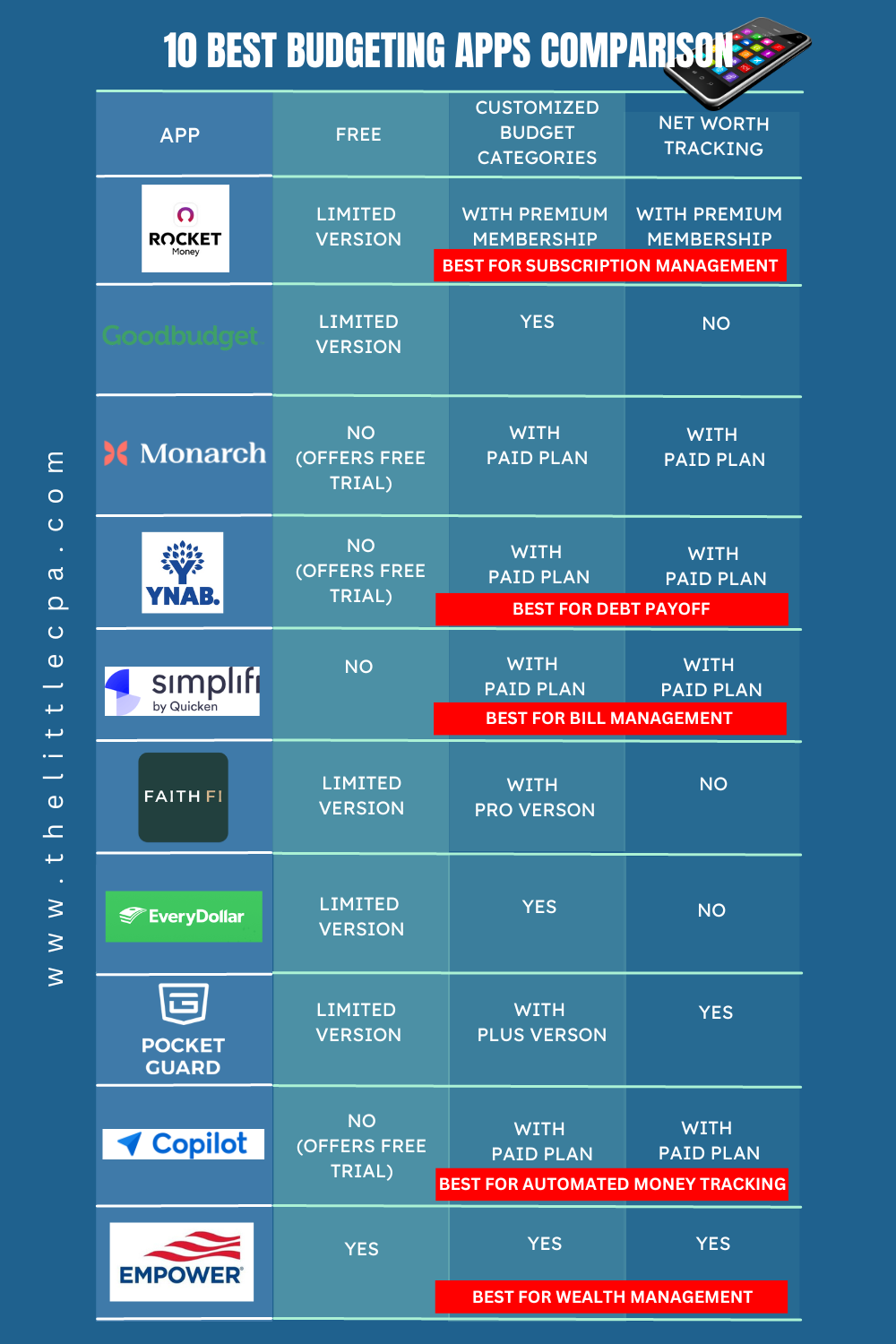

10 Best Budgeting Apps

- These apps rank among the best because they each boast a user-friendly interface – making it easy for users to navigate and comprehend.

- Each app demonstrates strong efforts to keep your data safe with two-factor authentication, secure data centers with 256-bit bank grade encryption or other secure measures.

- Most of the apps include features for setting and tracking financial goals, helping you stay motivated and focused on achieving your financial aspirations.

- All of these apps provide customized, visually comprehensive reports to help you monitor your spending.

__________________________________________

When Intuit announced it would no longer offer the Mint budgeting app after January 1, 2024, many budgeters were forced to decide whether –

- a) they should transition with Intuit onto Credit Karma, or

- b) they should search for the next best user-friendly budget app with similar features and minimal costs.

With so many budgeting applications on the market today, it can be difficult to choose one that suits your needs best.

To make this task easier, we’ve compiled a list of the top ten budgeting apps to give you an idea of which options might work well for you.

From comprehensive features like categorizing spending habits to easy-to-use interfaces, each app has something unique that can lend itself to helping reach those financial goals–so keep reading!

Oh, and in case you were wondering, this post is not sponsored by any of these apps! Keep reading for a non-biased review!

The 10 Best Budgeting Apps to Manage Your Finances Wisely

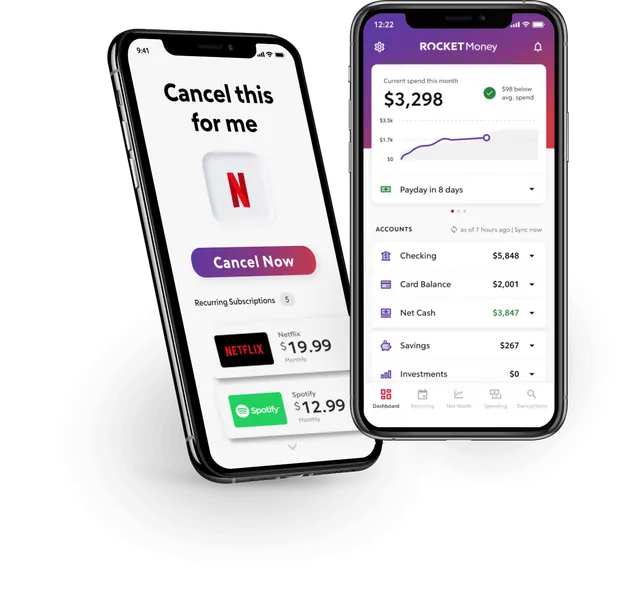

1. Rocket Money:

BEST APP FOR SUBSCRIPTION MANAGEMENT

Rocket Money (formerly Truebill) considers itself to be your primary financial control center.

The app automatically tracks different accounts and helps you navigate your finances each month in order to provide a clear picture of your income and expenses.

Pros:

- Expense Tracking: Rocket Money excels in tracking expenses, helping you identify areas where you can cut back.

- Net Worth Tracking: The net worth tab automatically updates the value of your assets and remaining balances on any debt. You can also add custom categories “like a high value sneaker collection” to your net worth statement.

- Subscription Management: This app instantly finds and tracks your subscriptions. With Premium Membership, a concierge is there when you need them to cancel services so you don’t have to. The service also attempts to get you fee refunds automatically

- Bill Negotiation: With Premium membership, the app automatically scans your bills to find savings. You can also upload and let their negotiators go to work for you to get the best possible rate.

- Customization: With Premium membership, enjoy the flexibility to customize your transactions and categories according to your unique financial situation.

Cons:

- Pay for Premium: While there’s a free version, some advanced features require a Premium membership. Premium members can choose on a sliding scale between $3-$12/month. Premium features include: Syncing your balance, Premium Chat, Cancellations Concierge, Custom Categories, Unlimited Budgets, Smart Savings, and More.

- No Debt Management Tool: Unlike many of the other apps on this list, Rocket Money does not offer a tool that manages your debt payoff progress.

Check out this review of Rocket Money on Reddit:

2. Goodbudget:

Goodbudget is a budget tracker for the modern age.

This virtual budget program keeps you on track with family and friends with the time-tested envelope budgeting method.

Pros:

- Budget Education: GoodBudget Offers a course that teaches you how to create a budget that works.

- Envelope System: Goodbudget utilizes the envelope budgeting method, providing a tangible and visual way to manage your money.

- Debt Payoff Progress: Goodbudget allows you to create Debt Accounts to track things like car loans, student loans, and credit cards you’ve stopped using and are working to pay off. The app provides visual data that allows you to see how much you still owe on your debt, so you can quickly see your payoff progress.

- Household Budgets: Goodbudget keeps you on the same page by syncing your household budget across all your iPhones and Androids. When you deduct money from an envelope, the person you’re sharing with knows what’s spent, where, and when.

- No Account Syncing Worries: Since Goodbudget is a manual entry system, there are no syncing issues, ensuring your data is always up-to-date.

Cons:

- Pay for Plus: While there’s a free version, some advanced features require a Plus membership. Plus membership includes unlimited envelopes, five devices, seven years of history and more.

- No Net Worth Tracking: Unlike many of the apps listed on this list, Goodbudget does not provide a net worth report.

- Time-Consuming: The manual entry process can be time-consuming, requiring discipline and consistency.

- Basic Design: Some users find the design to be a bit basic compared to more visually appealing alternatives.

Check out this review of Goodbudget on Reddit:

3. Monarch Money:

Monarch Money helps you get clarity, confidence, and peace of mind for your finances.

With Monarch Money, you can track all of your account balances, transactions, and investments in one place. You can also collaborate with your partner and reach your financial goals faster.

Pros:

- For Couples: Monarch helps couples work together on their finances. You can sync all of your bank accounts into one place, access Monarch with your own logins, and view joint reports for how you are doing.

- AI-Powered Insights: Monarch Money provides an AI powered assistant to help you manage your financial goals.

- Crypto Tracking: The app offers crypto tracking for virtual currency held in Coinbase.

- Expense Analysis: Enjoy in-depth expense analysis, allowing you to identify patterns and make adjustments accordingly.

- Net Worth Progress: You can sync all of your bank accounts automatically to Monarch to track your balances and net worth over time.

- Adviser Access: Your financial adviser can create their own login to help you track and reach your financial goals.

Cons:

- Pay for Plan: Once you complete Monarch Money’s free trial period, you must purchase a monthly or annual plan to pay for all features.

- No Debt Management Tool: Unlike many of the other apps on this list, Monarch Money does not offer a tool that manages your debt payoff progress.

Check out the review of Monarch Money on Reddit:

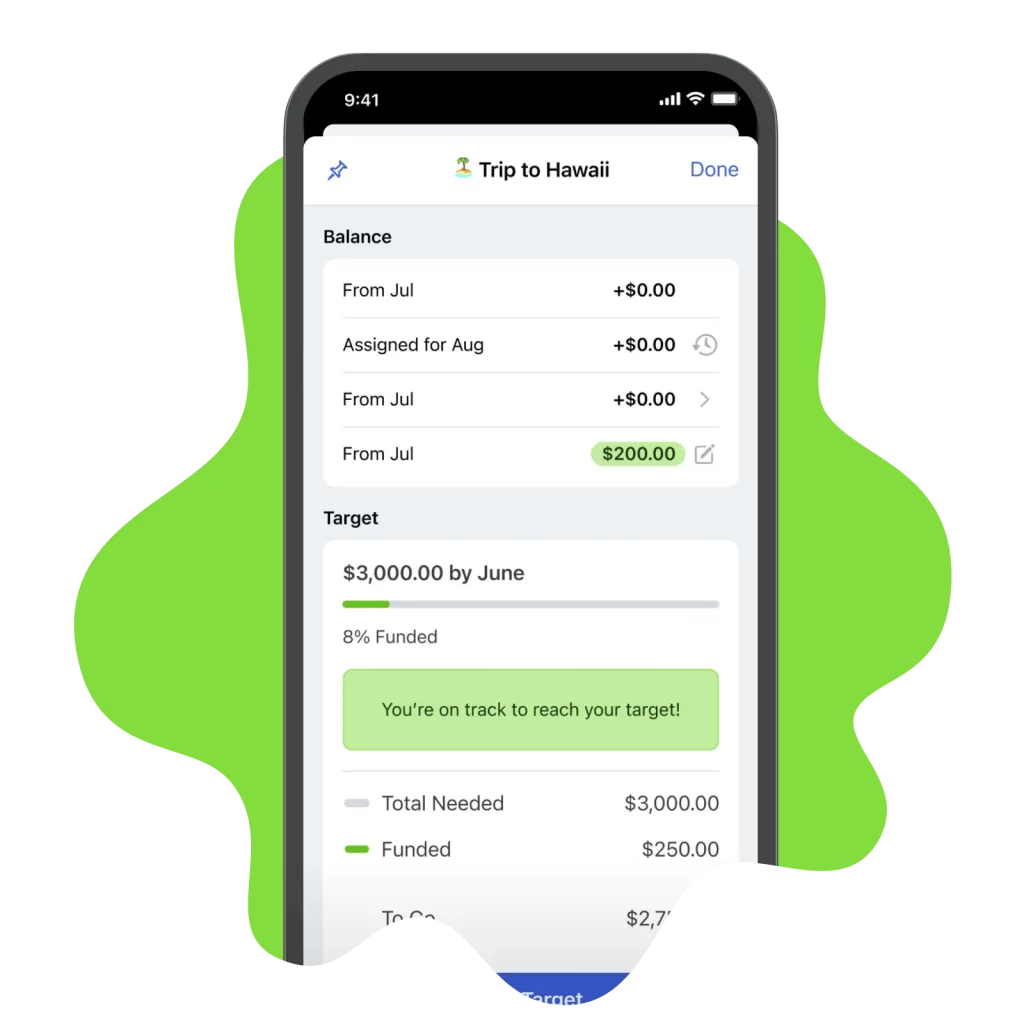

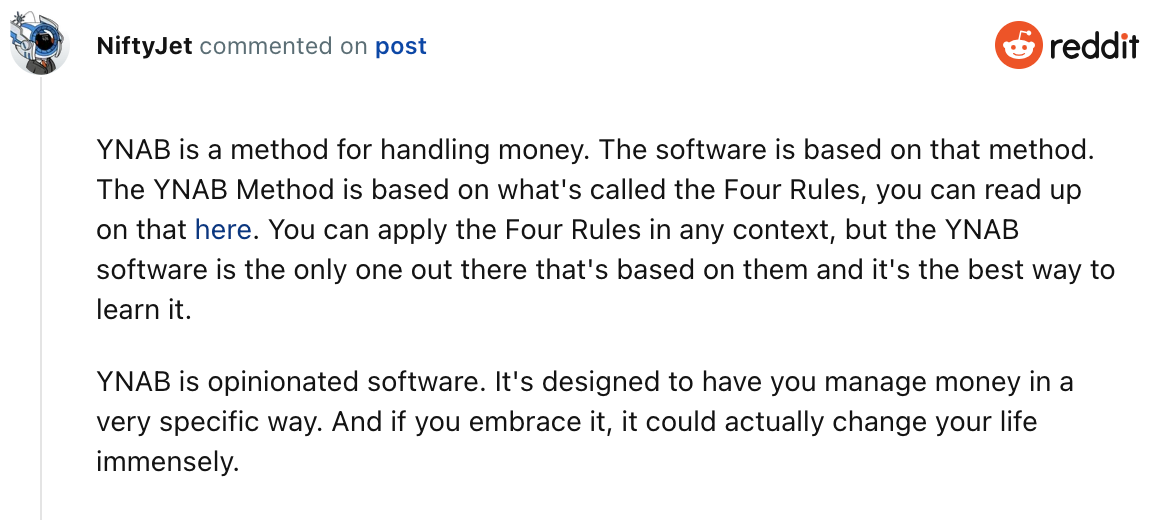

4. YNAB (You Need A Budget):

BEST APP FOR DEBT PAYOFF

With a customized method for managing money, YNAB is future-facing.

When you use YNAB, you’ll know where your money is and what it should be doing because you’ll be following the plan you made.

Pros:

- Rule-Based System: YNAB operates on a rule-based budgeting system, guiding users to allocate every dollar to a specific purpose. This approach promotes intentional and mindful spending.

- Educational Resources: YNAB provides extensive educational content, including tutorials and webinars, to help users improve their financial literacy. This support is beneficial for those looking to enhance their understanding of budgeting principles.

- Loan Calculator: On the app, you can add a loan account to your budget and calculate how much interest and time you’ll save for every extra dollar you put toward debt.

- Net Worth Graph: In the app, you can track accounts to receive a report on how mortgage payments, investments, and other changes in assets and liabilities impact your overall net worth.

Cons:

- Pay for Plan: Once you complete YNAB’s free trial period, you must purchase a monthly or annual plan to pay for all features.

- Learning Curve for New Users: The YNAB budgeting philosophy can be different from traditional budgeting methods, requiring users to adapt to a new approach. This learning curve might be a challenge for some users.

Check out this Reddit review of YNAB:

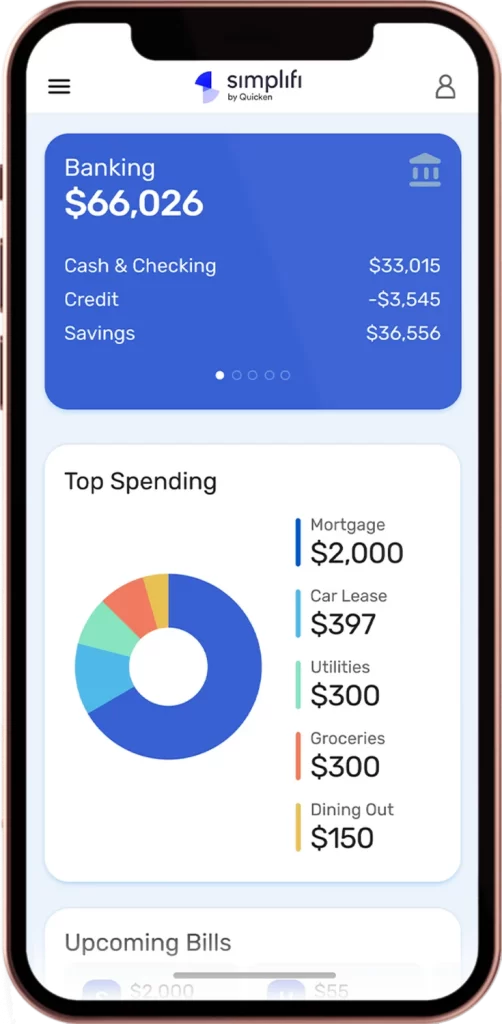

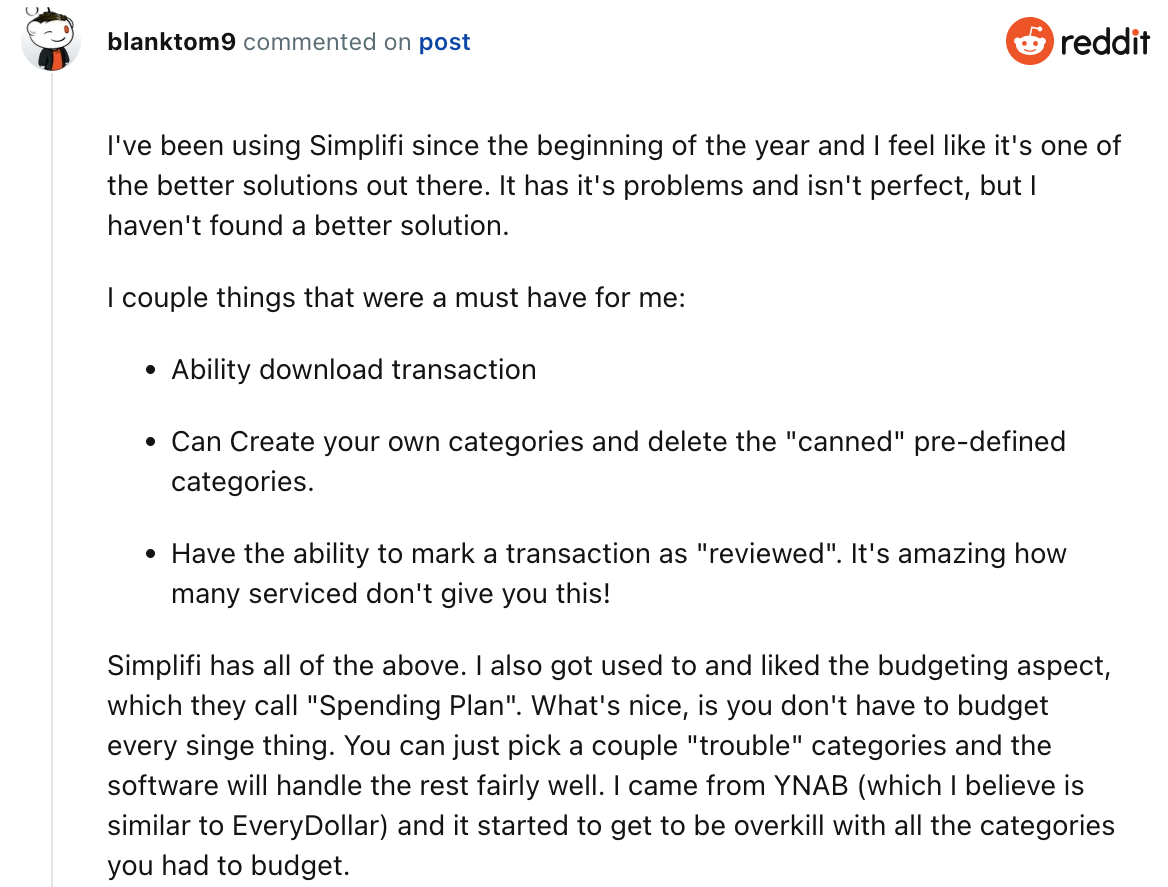

5. Simplifi:

BEST APP FOR BILL MANAGEMENT

Quicken Simplifi is a powerful, easy-to-use tool for all the essentials of your financial journey

On the app, you can track & categorize your spending, get a customizable spending plan, reach your savings goals, and plan for the future with projected cash flows.

Pros:

- Bill Management: The app excels in bill management, providing users with timely reminders and insights to stay on top of due dates, helping avoid late fees.

- Share with Partner: You can share your Simplifi data with one additional member, who will need to have their own Quicken ID and password, but who do not need to have their own Quicken Simplifi Subscription.

- Net Worth Report: Simplifi’s Net Worth Report shows you your net worth over time based on historical account balances.

Cons:

- Pay for Plan: You must purchase a monthly plan to pay for Simplifi’s features. Although, Simplifi’s monthly fee is much lower than other apps on this list.

- No Debt Management Tool: Unlike many of the other apps on this list, Simplify does not offer a tool that manages your debt payoff progress.

Check out this Reddit review of Simplifi:

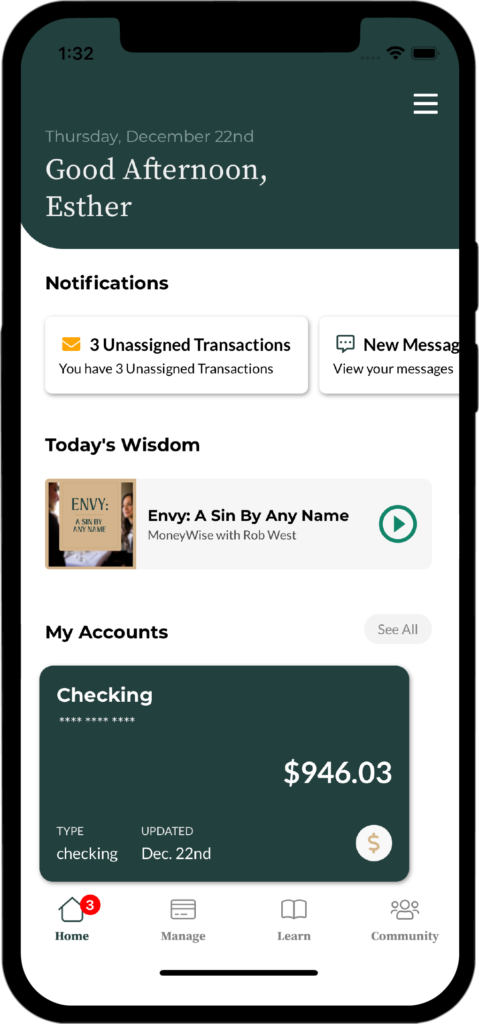

6. FaithFi:

BEST APP FOR CHRISTIAN FINANCE

The FaithFi app helps you integrate your faith with your finances by combining an easy to use budget system with incredible resources to help you learn what the Bible has to say about managing money.

Pros:

- Faith-Based Approach: FaithFi incorporates a Christian perspective into budgeting, allowing users to align their financial goals with their values and principles.

- Community Features: FaithFi includes community features, providing a platform for like-minded individuals to connect, share insights, and support each other in their financial journeys.

- Envelope System: FaithFi utilizes the envelope budgeting method, providing a tangible and visual way to manage your money.

- Customizable Categories: With a Pro account, you can customize expense categories, tailor your budget to your specific needs and ensuring it reflects your unique financial priorities.

- Educational Resources: As a faith-based app, FaithFi may offer educational resources that integrate financial wisdom with Biblical teachings.

Cons:

- No Debt Management Tool: Unlike many of the other apps on this list, FaithFi does not offer a tool that manages your debt payoff progress.

- No Net Worth Tracking: Unlike many of the apps listed on this list, FaithFi does not provide a net worth report.

- Pay for Pro: The free version of FaithFi has limited features. The Pro version allows you to securely connect your bank accounts, run custom reports, and many other customizable features

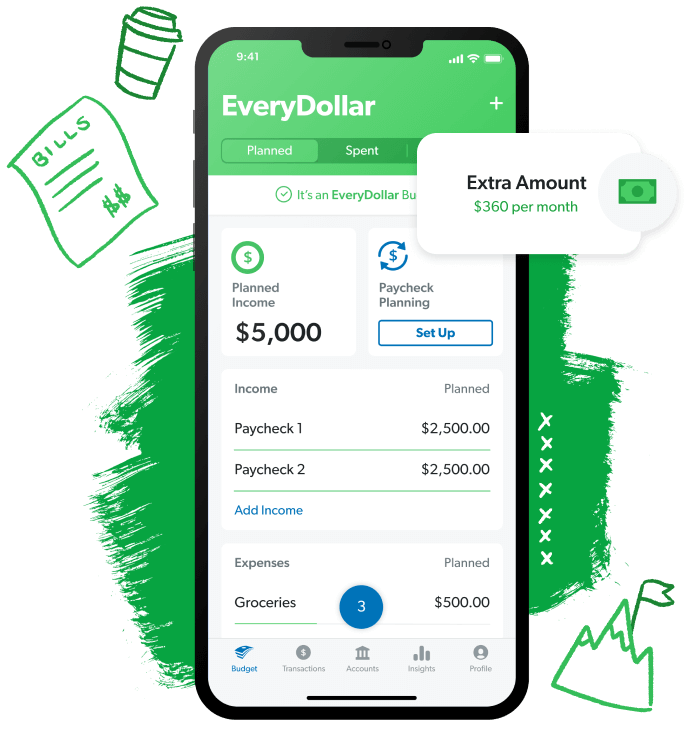

7. Every Dollar:

EveryDollar, a product of Ramsay Solutions, is built on the zero-based budgeting method. You give every dollar a job to do so your income minus your expenses always equals zero.

The app encourages simple budgeting that puts you in control of your finances.

Pros:

- Zero-Based Budgeting: EveryDollar follows the zero-based budgeting method, where every dollar is assigned a specific purpose. This approach encourages intentional and comprehensive budgeting.

- Expense Tracking: The app excels in tracking expenses, providing users with a clear overview of where their money is going and helping them stay accountable to their budget.

- Track Your Debts: The app will display any manually added debts from smallest to largest since it encourages users to use the debt snowball payoff method. EveryDollar will let you know if your planned amounts will keep you on track. In the app, you can check and adjust your target debt-free date at any time. It will also update all of your numbers to show you how much you’ll have to pay on each debt each month.

Cons:

- Pay for Premium: Certain features within EveryDollar may require a subscription. These features include bank connectivity, financial roadmap, custom budget reports and more!

- Dave Ramsey Integration: EveryDollar is associated with financial influencer Dave Ramsey, making it an ideal choice for individuals following his financial principles – or a disappointment for those who strongly dislike his money philosophy. It aligns with the teachings of Ramsey’s popular Total Money Makeover.

- No Net Worth Tracking: Unlike many of the apps listed on this list, EveryDollar does not provide a net worth report.

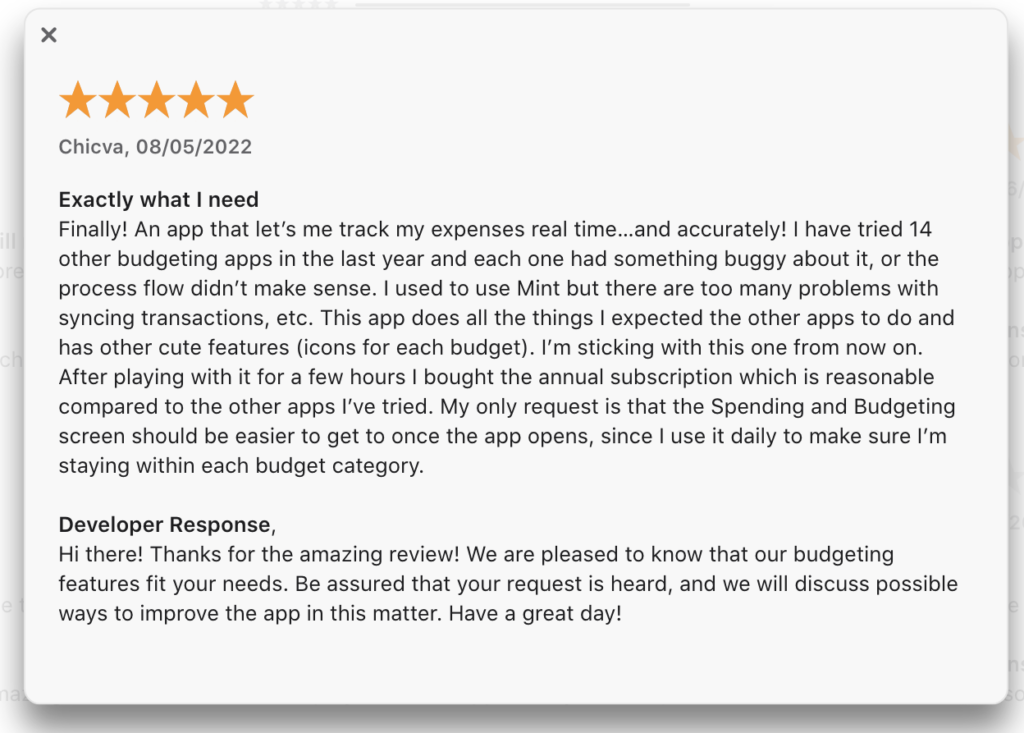

8. PocketGuard:

PocketGuard is designed to help you manage your money and track their spending.

It offers features such as budgeting, expense tracking, and bill management to provide you with a comprehensive view of their financial situation.

Pros:

- Free Personal Finance Course: PocketGuard ffers a free course to help you improve your financial literacy and budget the right way.

- Net Worth Tracking: Unlike many other budgeting apps, PocketGuard offers Net Worth Tracking with its free version.

- Bill Organizer and Negotiation: PocketGuard bill organizer gives you an easy way to negotiate better rates with your provider. So you can optimize your budget by cutting costs on services you use.

- Debt Payoff Plan: With the Plus version, you can setup a debt payoff plan, allocate money towards the plan and receive notifications if you fall of your plan.

Cons:

- Pay for Plus: The PocketGuard App offers more free features than most other budget apps. You do, however, have to pay for PocketGuard Plus to access unlimited budget categories, unlimited bank transactions and more.

Check out this App Store review of PocketGuard:

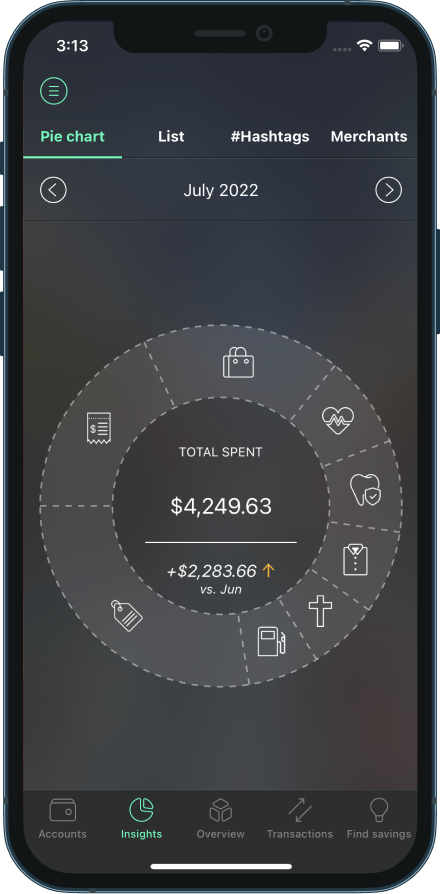

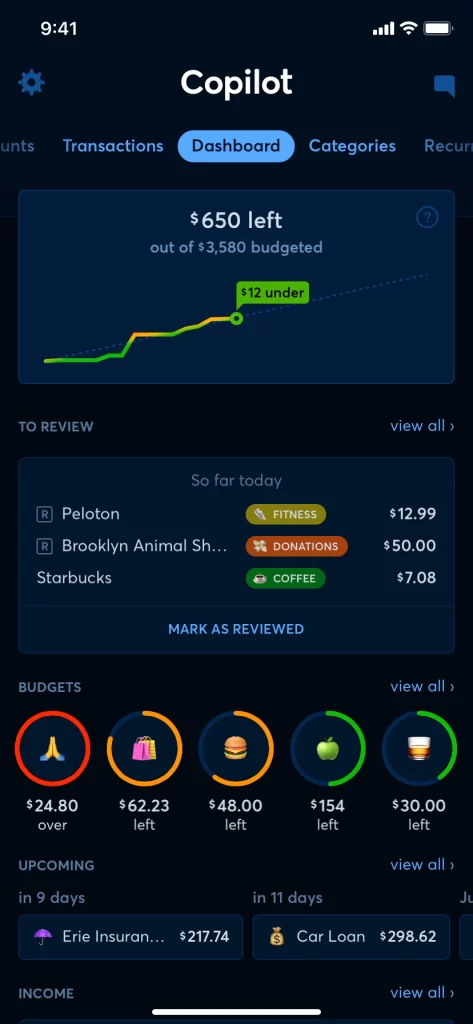

9. Copilot

BEST APP FOR AUTOMATED MONEY TRACKING

Copilot Money is a personal finance tracker that helps you monitor your spending, track your investments, and budget like a pro.

Pros:

User-Friendly Interface: While all of the listed apps boast a user-friendly interface, Copilot’s goes above and beyond – allowing you to customize your experience with light or dark mode and quick-glance home screen widgets.

AI Insights: Copilot’s machine learning categorizes transactions for powerful insights into your spending.

Net Worth Tracking: Copilot provides consolidated views of your accounts and investments so that you can monitor your net worth

Crypto Tracking: Copilot supports integrations for the several crypto exchanges.

Real Estate: In the app, you can enter your property address and Copilot will track your home’s estimated value!

Cons:

- Pay for Plan: Once you complete Copilot’s free trial period, you must purchase a monthly or annual plan to pay for all features.

- Limited Platform Availability: Currently, Copilot is only available on iOS and macOS devices, excluding Android or Windows users.

- No Debt Management Tool: Unlike many of the other apps on this list, Copilot does not offer a tool that manages your debt payoff progress.

Check out this review of Copilot on Reddit:

10. Empower Personal Dashboard:

BEST APP FOR WEALTH MANAGEMENT

Empower is a a financial services company on a mission to empower financial freedom for all.

They work with individuals and all sizes of organizations to offer investment, wealth management and retirement solutions, along with the free Empower Personal Dashboard™, so everyone can have a clear and simple understanding of where their finances are today and where they’re headed.

Pros:

- Free: This app and all of its financial features are the four-letter F-word we love to hear – FREE.

- Portfolio Analysis: Users can benefit from a comprehensive portfolio analysis feature.

- Retirement Planning: The retirement planner tool can help users prepare for their future financial needs.

- Useful Calculators: Empower Personal Capital provides various calculators for budgeting, savings, and debt management.

- Personalized Investment Portfolio: Users can get a personalized investment portfolio based on their financial goals and risk tolerance.

- Tax Optimization Strategies: The app offers tax optimization strategies to maximize your returns.

- Automatic Rebalancing: The app rebalances your portfolio to maintain diversification.

Cons:

- Limited Budget Features: You can only set a single overall monthly budget amount – budget category customization is limited.

- Sales Calls from Financial Advisors: Financial advisors may reach out to sell wealth management services.

Check out this review on the Empower Personal Dashboard on the Google Play Store:

At first glance, it looks simple/basic; that’s what it turns out to be, data driven and no frills! i can view all the accounts with each of their breakdowns by scrolling down the screen. it’s also one of the most accurate apps to extract transaction names (least amount of work for me to rename them, while still an option). compared to some other free apps with tons of distracting paid content/advertising, this is a breath of fresh air! (only complaint is that it doesn’t budget).

Conclusion: The 10 Best Budgeting Apps

Although we listed each app’s Pay for Service item as a Con – note that you are likely to receive a positive return on investment with the purchase and use of any quality budgeting app.

The best budget app for you ultimately depends on your unique financial goals, preferences, and willingness to invest time and money. Each app has its strengths and weaknesses, so weigh the pros and cons carefully to find the perfect fit for your financial journey.

And, if you are looking for a budget tool that doesn’t look like an app, check out 3 Best Budget Tools for a few great budget options that you can’t find in an App Store.

Happy budgeting!

Disclaimer:

The information provided on this blog is for educational and informational purposes only. While every effort has been made to ensure the accuracy and reliability of the content, we do not make any representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information.

Please note that the financial advice and information presented on this blog are not personalized to your specific financial circumstances. It is essential to consult with a qualified professional, such as a financial advisor or accountant, before making any financial decisions or taking any actions based on the information provided here.

We strongly encourage our readers to conduct thorough research and verification independently. The information on this blog should not be considered as financial, investment, or legal advice. Any reliance you place on the information provided is strictly at your own risk.

It is important to understand that any financial product or service mentioned or promoted on this blog may have its own risks and potential drawbacks. We advise our readers to carefully read the terms, conditions, and fine print associated with any product or service before making any investment decisions.