On August 24, 2022, the White House announced Biden’s one-time student loan forgiveness plan.

The plan summarized Biden’s three-part plan to cancel up to $10,000 in student loan debt for low and middle income borrowers.

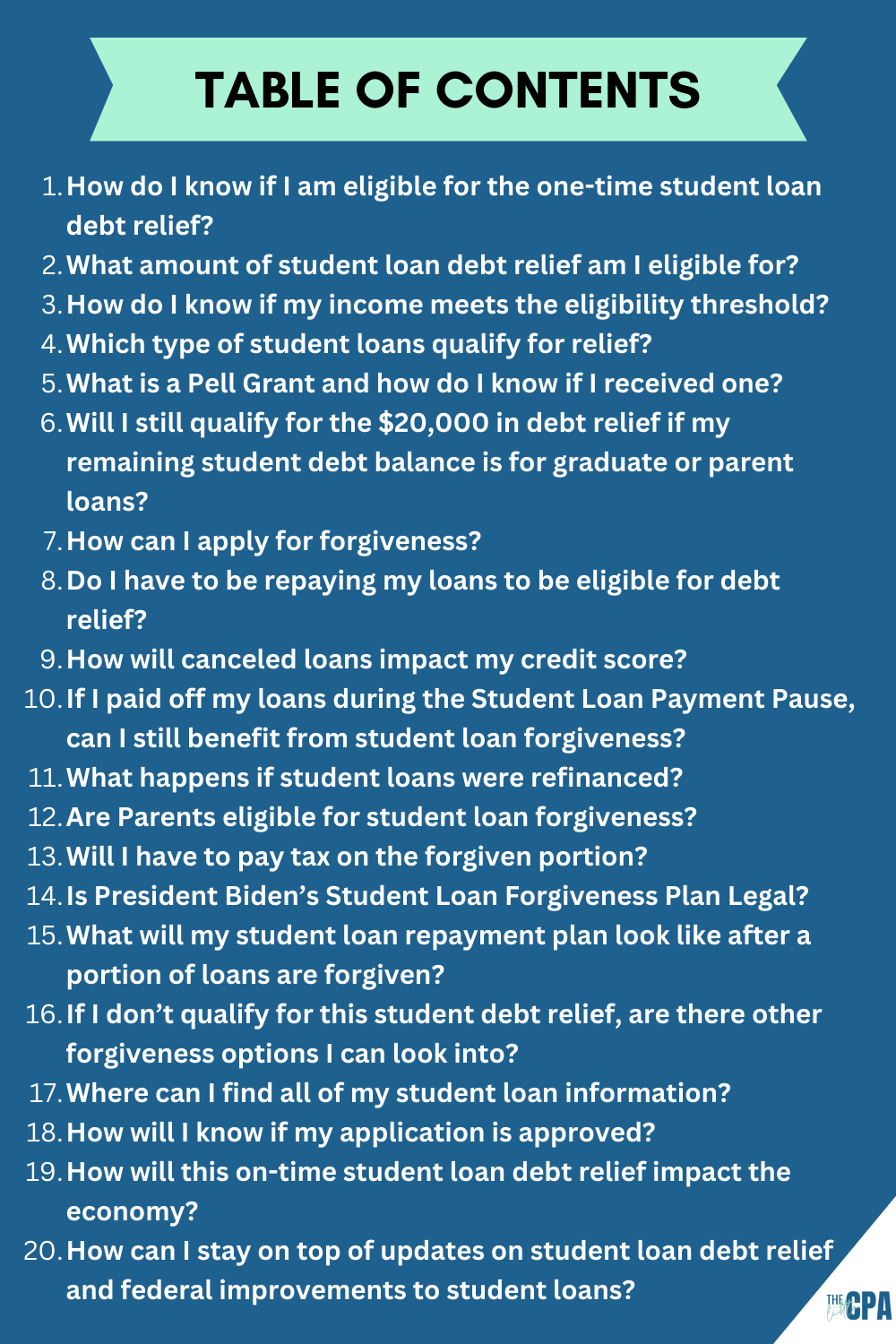

If you heard about the plan but are still not sure what it is, whether it’s legal, how to apply or whether you’re eligible, you are not alone.

Here are 20 questions and answers about this one-time student loan relief to help clear things up.

1.How do I know if I am eligible for the one-time student loan debt relief?

Eligibility is determined by your income level, the loan type, and whether or not you received a Pell Grant.

2. What amount of student loan debt relief am I eligible for?

2. What amount of student loan debt relief am I eligible for?

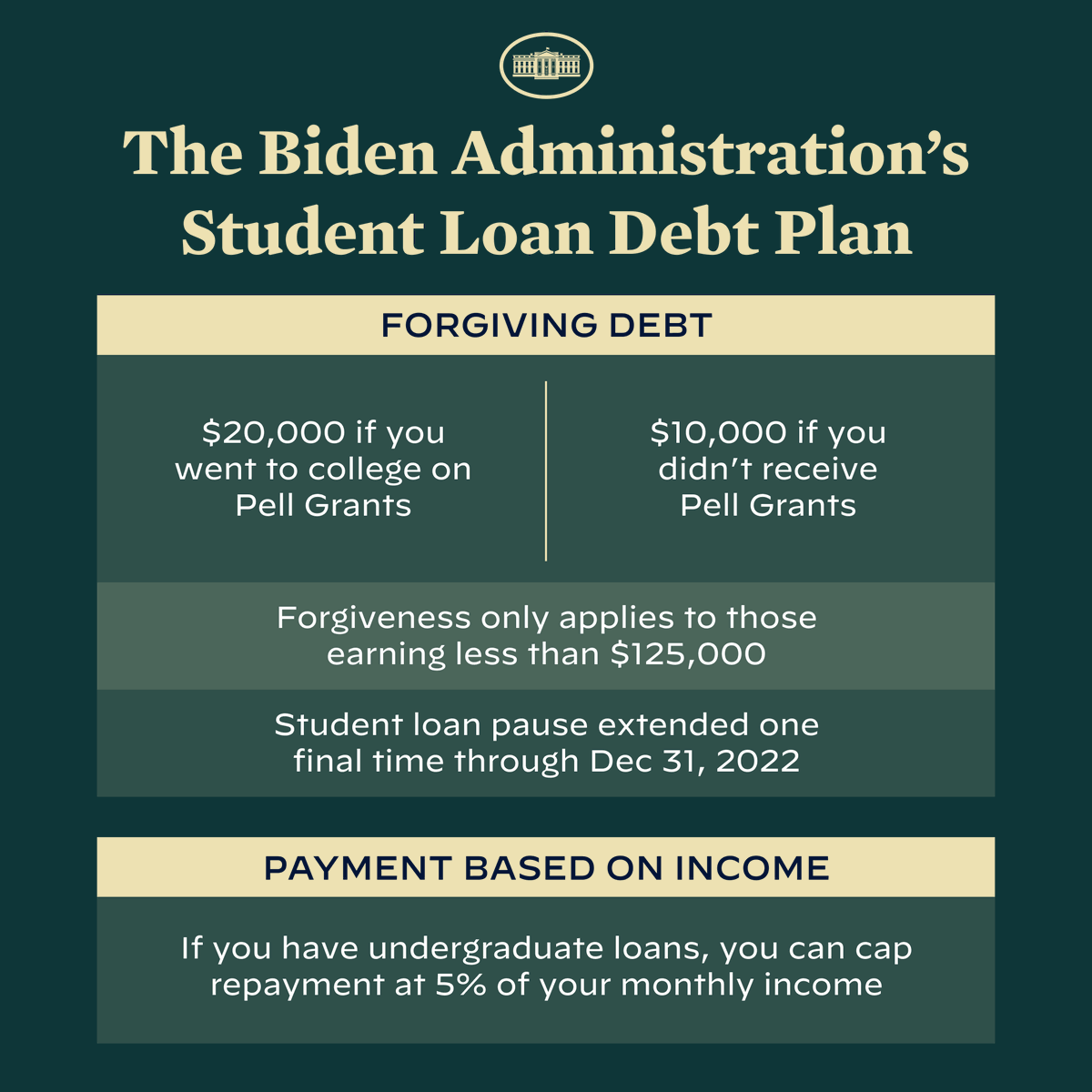

If you received a Pell Grant in college and meet the income threshold, you will be eligible for up to $20,000 in debt cancellation.

If you did not receive a Pell Grant in college and meet the income threshold, you will be eligible for up to $10,000 in debt cancellation.

Keep in mind, your relief is capped at the amount of your outstanding debt.

For example, if you are eligible for $20,000 in debt relief, but have a balance of $15,000 remaining, you will only receive $15,000 in relief.

For more information, visit Federal Student Aid.

3. How do I know if my income meets the eligibility threshold?

Your 2020 or 2021 adjusted gross income (AGI) will determine your eligibility for debt cancellation.

AGI is calculated on your personal income tax returns.

On the 2020 and 2021 Form 1040, AGI is reported on Line 11.

To be eligible, your 2020 or 2021 must have fallen below $125,000 (for individuals) or $250,000 (for married couples or heads of households).

And yes, you need to have a 2020 or 2021 tax return on file to qualify!

4. Which type of student loans qualify for relief?

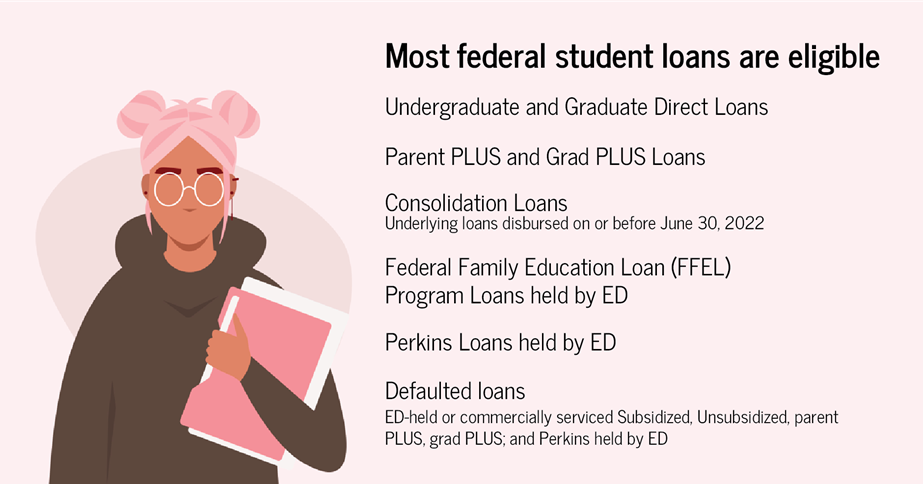

Most federal loans meet the criteria for the one-time student loan debt relief. Eligible loans include –

- William D. Ford Federal Direct Loan (Direct Loan) Program loans

- Federal Family Education Loan (FFEL) Program loans held by U.S. Department of Education (ED) or in default at a guaranty agency

- Federal Perkins Loan Program loans held by ED

- Defaulted loans (includes ED-held or commercially serviced Subsidized Stafford, Unsubsidized Stafford, parent PLUS, and graduate PLUS; and Perkins loans held by ED)

Consolidation loans are also eligible for relief, as long as all of the underlying loans that were consolidated were ED-held loans and were disbursed on or before June 30, 2022.

Additionally, consolidation loans comprised of any FFEL. or Perkins loans not held by ED are also eligible, as long as the borrower applied for consolidation before Sept. 29, 2022.

For more information, visit Federal Student Aid.

5. What is a Pell Grant and how do I know if I received one?

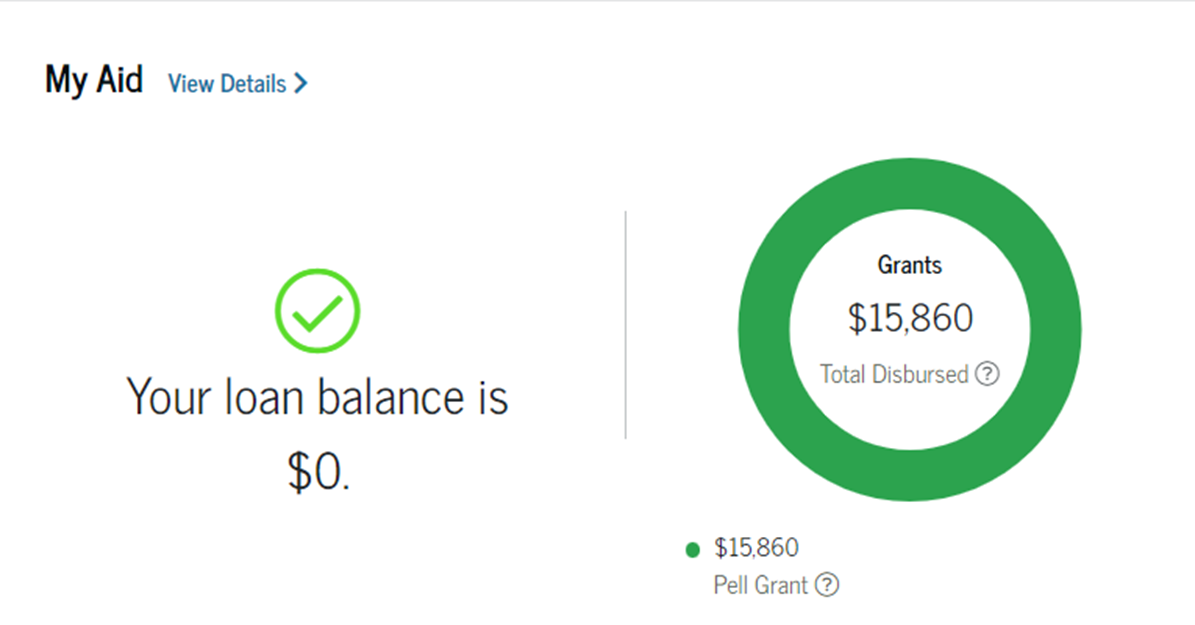

Federal Pell Grants typically are awarded to undergraduate students with low or moderate income. You can find out whether or not you received a Pell Grant by visiting studentaid.gov.

When you reach the homepage, click “Login,” or “Create an Account.”

After you login, your dashboard will display the details of your Pell Grant, if any.

For those who received a Pell Grant prior to 1994, that information won’t display in StudentAid.gov, but you’ll still receive the full benefit.

6. Will I still qualify for the $20,000 in debt relief if my remaining student debt balance is for graduate or parent loans?

According to studentaid.gov, as long as you received at least one Pell Grant of any amount, you qualify for $20,000 in debt relief.

This debt relief will be applied to eligible loans, such as undergraduate, graduate, or parent loans. It doesn’t matter if the Pell Grant was used for the same program of study or at the same school as your federal student loan(s).

7. How can I apply for forgiveness?

If the U.S. Department of Education doesn’t have your income data, you should complete the online application.

The application is expected to request the following information:

- Name

- Social Security Number

- Email Address

- Phone Number

Yup, that’s it!

If needed, someone from the Department of Education might email you for more documentation.

Additional documentation requests could include verification of your income, verification of your parent’s income or loan records.

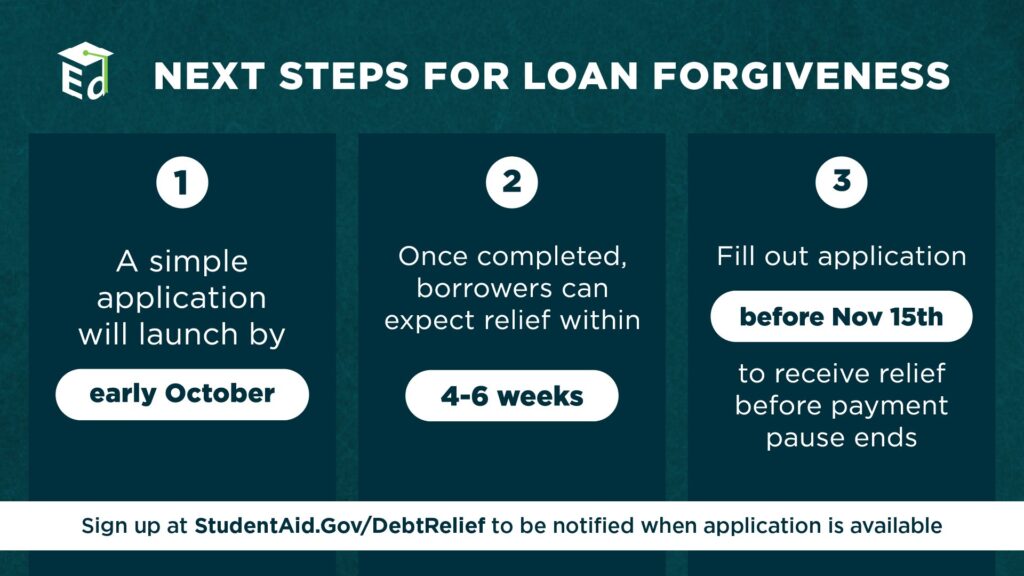

The final application should be available online October 2022 (note: this date is subject to change).

Borrowers will have until Dec. 31, 2023 to submit their applications, although, Borrowers are advised to apply before November 15th in order to receive relief before the payment pause expires on December 31, 2022.

Most borrowers who apply can expect relief within six weeks.

If you would like to be notified when the application is open, please subscribe to the Department of Education.

Bonus: Should I complete the Beta launch application?

Well, that’s up to you.

But, know that, if you submit an application during the Beta Launch, it will be processed when the form officially launches, and you won’t need to resubmit.

8. Do I have to be repaying my loans to be eligible for debt relief?

No. Borrowers are eligible for debt relief regardless of whether they’re in repayment, in school, or in grace, as long as they meet the income requirements and have eligible loans.

Defaulted loans are also eligible for debt relief. If you have a remaining balance on your defaulted loan(s) after relief is applied, consider StudentAid.gov recommends getting or staying out of default through the Fresh Start initiative.

9. How will cancelled loans impact my credit score?

According to Student Loan Planner, student loan forgiveness could cause your credit score to temporarily dip.

While this is not a bad thing, check out the full article to learn all the ways student loan forgiveness can affect your credit.

10. If I paid off my loans during the Student Loan Payment Pause, can I still benefit from student loan forgiveness?

You might be eligible for a refund on the amount you paid during the Student Loan Payment Pause.

Learn more about this refund by reading this article from The College Investor.

11. What happens if student loans were refinanced?

Sometimes, loan borrowers will refinance their loans to lower their interest rate, lower their monthly payment or other reasons.

When a loan is refinanced, a new lender pays off your old loan and replaces the loan. If the new lender is a private lender, then the loans will not qualify for the student loan debt relief.

Learn more about refinanced student loans on SoFi!

12. Are Parents eligible for student loan forgiveness?

All US. Department of Education loans (ED-held loans), including PLUS loans for parents and graduate students, are eligible for relief.

13. Will I have to pay tax on the forgiven portion?

13. Will I have to pay tax on the forgiven portion?

Federal income tax, no.

The American Rescue Plan declared an income tax exclusion on all federal student loan debt forgiven or discharged by December 31, 2025.

Click here to learn which federal loans qualify under this exclusion.

State income tax, however, gets a bit more tricky.

Taxpayers in North Carolina, Indiana, Mississippi, Arkansas, Minnesota, Wisconsin and California might be taxed.

For updates on which states will tax the forgiven portion of your student loans, check out the Tax Foundation’s article States That Might Tax Student Loan Debt Cancellation.

14. Is President Biden’s Student Loan Forgiveness Plan Legal?

This is another tricky one.

According to Bloomberg, the plan relies on the Higher Education Relief Opportunities for Students Act (HEROES).

Originally passed to serve borrowers serving in the military after 9/11, the HEROES Act allegedly permits the Education Secretary to cancel student loans to address financial hardship arising out of the Covid-19 pandemic.

Challengers argue that this type of relief under the HEROES Act is unconstitutional.

The interpretation of the HEROES Act could raise questions in court – in fact, twenty-two Republican governors have signed a letter sent to President Joe Biden calling on him to withdraw his student loan forgiveness plan.

If reports conclude that the President does not have legal authority to act, Congress might consider legislation to uphold the cancellation.

For a full breakdown of the legal challenges behind student loan cancellation, check out this breakdown from Student Loan Planner.

15. What will my student loan repayment plan look like after a portion of loans are forgiven?

Student Loan Planner has a comprehensive calculator that allows you to see your monthly federal loan payments over time, interest accrual, and subsidies you may qualify for.

Check it out here!

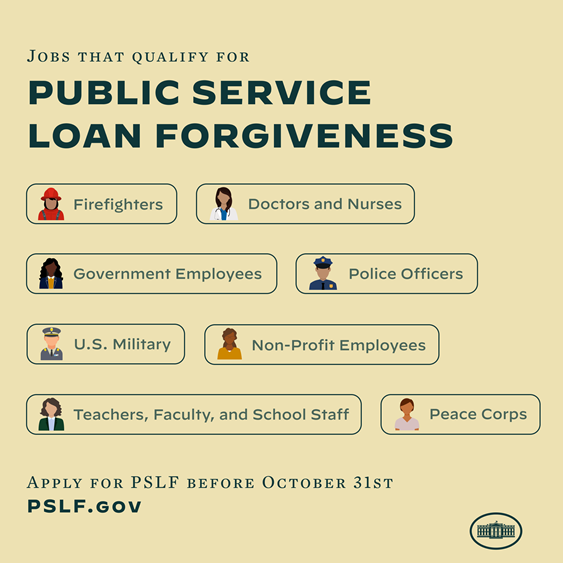

16. If I don’t qualify for this student debt relief, are there other forgiveness options I can look into?

Yes! Other Student Loan Forgiveness options include:

- Public Service Loan Forgiveness,

- Teacher Loan Forgiveness,

- Closed School Discharge,

- Nurse CORPS Loan Repayment Program

- Perkins Loans Cancellation and Discharge, and

- … more!

You can read more about these forgiveness programs here.

17. Where can I find all of my student loan information?

If you know the name of the company who services your student loans, you can login to your account with your service provider.

Your account should provide all of your remaining loan balance, repayment plan and more. Here is a list of the largest student loan servicers:

- American Education Services (AES)

- CornerStone

- EdFinancial (HESC)

- FedLoan Servicing (PHEAA)

- Granite State (GSMR)

- Great Lakes Educational Loan Services, Inc.

- MOHELA

- Aidvantage

- Nelnet

- OSLA Servicing

For federal student loans, all of your student loan information is available on studentaid.gov.

When you log into your account, you can retrieve a loan breakdown that includes your loan servicer, loan types, loan balance and more.

18. How will I know if my application is approved?

The Federal Student Aid website states the following:

We’ll notify you when your application has been approved and sent to your loan servicer to process your debt relief. Your loan servicer will notify you when your debt relief has been applied and will share any additional information, such as updates to your outstanding loan balance and updated monthly payment amount (if you still have a balance).

19. How will this on-time student loan debt relief impact the economy?

Student loan cancellation could impact the economy in a plethora of ways. Here are a few:

Inflation

It’s possible that student loan cancellation could give borrowers more purchasing power to buy goods, which would drive up our record high inflation.

Although, some would argue that the income threshold and forgiveness levels are too low to significantly impact inflation.

Learn more on the Wall Street Journal.

Student Loan Asset Backed Securities (SLABS) could be negatively impacted by student loan cancellation due to the decreased debt, since their value is dependent on the amount of student loan debt.

Tax

To pay for this, the government will either need to cut spending in certain areas or increase tax revenue.

Learn more on The Wall Street Journal.

Consumer debt

Student loan cancellation could free up borrower pockets to pay off other types of credit cards and other types of consumer debt.

20. How can I stay on top of updates on student loan debt relief and federal improvements to student loans?

You can sign up for email updates from the U.S. Department of Education here.

Beware of Scams

You might be contacted by a company saying they will help you get loan discharge, forgiveness, cancellation, or debt relief for a fee.

You never have to pay for help with your federal student aid. Make sure you work only with the U.S. Department of Education and our loan servicers, and never reveal your personal information or account password to anyone. Our emails to borrowers come from noreply@studentaid.gov, noreply@debtrelief.studentaid.