Key Points:

- Charitable Remainder Trusts (CRTs) can provide an immediate charitable tax deduction and convert highly appreciated assets (stocks, bonds, etc.) into a stream of income.

- CRTs offer a reliable income stream, tax benefits, efficient wealth transfer, and increased philanthropic impact, especially in high-interest rate environments.

- Despite their considerable benefits, CRTs also have limitations such as being irrevocable, substantial initial funding requirements, and strict transaction provisions.

Why a Charitable Remainder Trust Belongs on Your Radar

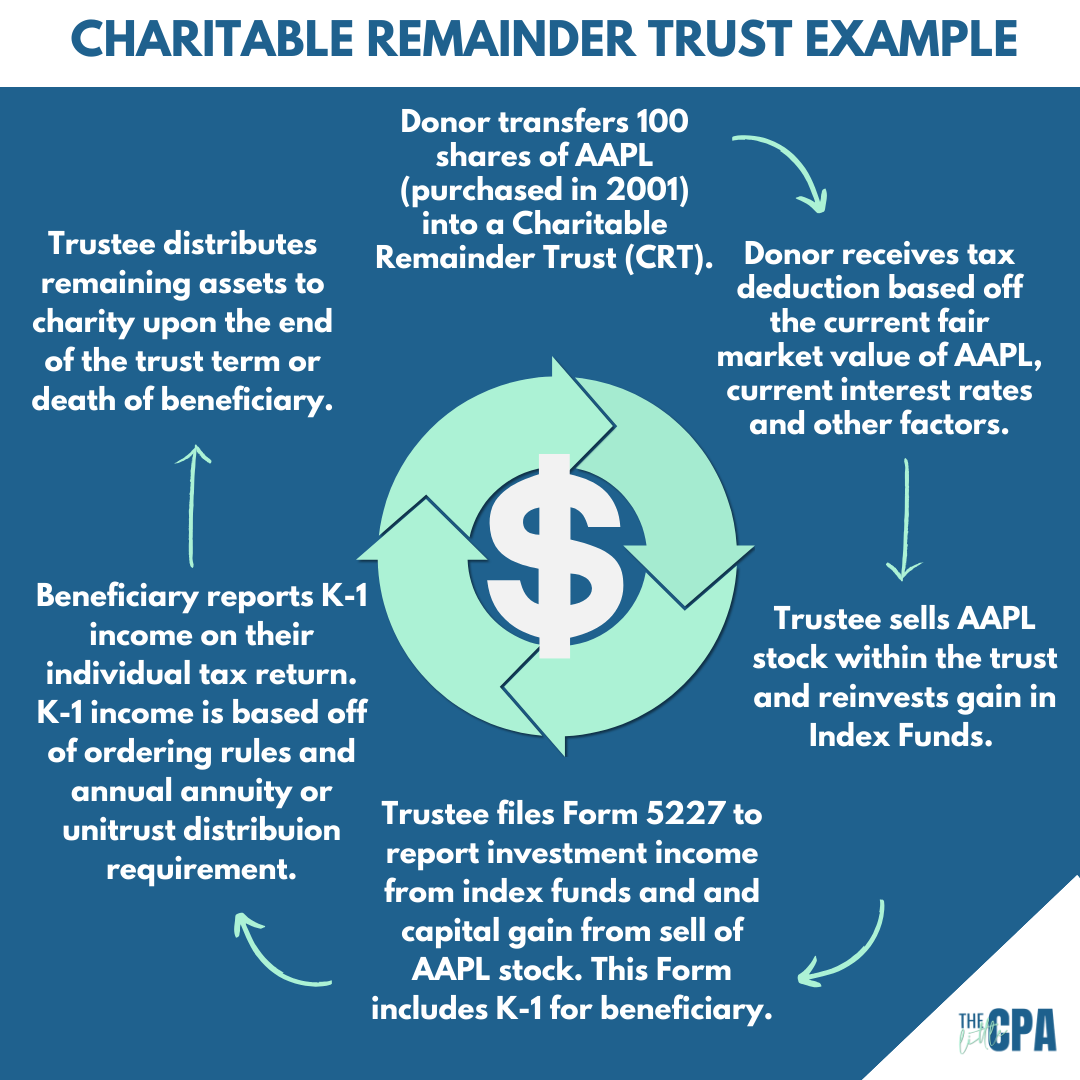

For high-net-worth individuals and families with concentrated wealth, a Charitable Remainder Trust (CRT) serves as a sophisticated vehicle for both tax-efficient diversification and long-term philanthropy.

This irrevocable “split-interest” trust is often created when taxpayers face a major liquidity event where immediate capital gains taxes could otherwise erode a significant portion of the proceeds.

By transferring these complex assets into a CRT, you can defer taxes, secure a lifetime income stream, and preserve a larger pool of capital to grow your legacy.

Key Players in CRTs

A CRT involves four primary roles that work together to protect your assets:

- Donor: You transfer appreciated assets (stocks, real estate) into the irrevocable trust.

- Trustee: A professional (like a bank) manages the investments.

- Beneficiary: You or your spouse receive regular income from the trust.

- Charitable Beneficiary: The remaining assets are donated to your chosen charity after the trust term ends.

How the Payouts Work

The income generated by the trust—dividends, interest, and gains—is paid to you over a set term or for your lifetime.

For example, if the trust sells stock for a $1 million gain, that gain isn’t taxed upfront. Instead, it is distributed to you as taxable income over many years, allowing the full $1 million to continue growing inside the trust.

Annuity Trust vs. Unitrust

One of the major benefits of a charitable remainder trust is the flexibility in how you get paid:

- CRAT (Annuity Trust): You receive a fixed dollar amount every year, regardless of market performance. This offers stability but no protection against inflation.

- CRUT (Unitrust): You receive a fixed percentage of the trust’s value, re-calculated annually. If your investments grow, your paycheck grows.

IRS Income Ordering Rules

When the trust pays you, the IRS follows a “Worst-In, First-Out” hierarchy for taxes. You must report income in this specific order:

- Ordinary Income: Interest and dividends.

- Capital Gains: Gains from the sale of assets within the trust.

- Tax-Exempt Income: Municipal bond interest.

- Return of Principal: Tax-free distribution of your original investment.

The Strategy Behind High-Interest Rates

One of the most overlooked charitable remainder trust benefits occurs during high-interest rate environments. When the IRS “7520 rate” is high, the mathematical value of the “remainder” that will go to charity is considered larger. This results in a much higher immediate income tax deduction for you the year you fund the trust.

The Deduction

When you fund a CRT, you receive an immediate income tax deduction, but it isn’t for the full value of the asset.

Instead, the IRS uses a formula to calculate the “present value” of what the charity is expected to receive years from now. This calculation depends on the length of the trust term and the Section 7520 interest rate.

The Pros

- Income Stream: CRTs provide a reliable income stream, often based on a fixed percentage of the trust’s initial value (annuity trust) or the fair market value at the beginning of the tax year (unitrust).

- Immediate Tax Deduction: You get a deduction today for a gift that happens in the future.

- Capital Gains Deferral: Sell “big” assets without the “big” tax bill.

- Estate Tax Reduction: Assets in a CRT are removed from your taxable estate.

- Philanthropic Impact: High-interest rates can boost the ultimate donation to your chosen charitable organizations, allowing you to make a more significant impact on the causes you care about.

The Cons

- Irrevocability: Once the assets are in, you can’t take them back.

- Complexity: These require professional setup and annual tax filings (Form 5227).

- Complexity and Costs: Setting up and managing a CRT can be complex and may involve legal and administrative costs.

While CRTs offer income, the payments for Charitable Remainder Unitrusts (CRUTs) are not fixed and may fluctuate based on the trust’s performance, which can create uncertainty.

Disclaimer: This material is for informational purposes only and is not intended as tax, legal, or accounting advice. Consult your own advisors before making significant financial commitments.

General Information Only: This content is prepared by The Little CPA for informational and educational purposes only. It does not constitute financial, tax, legal, or investment advice. While we strive for accuracy, the rapidly changing nature of tax laws—means this information may not apply to your specific situation.

No Professional-Client Relationship: Your use of this website or engagement with this content does not create a CPA-client relationship. You should consult with a qualified professional who is familiar with your individual financial circumstances before making any significant financial decisions.

Third-Party Risk: References to specific software, banks, or storage providers are not endorsements. We are not liable for any issues, data breaches, or financial losses that may arise from your engagement with third-party vendors.

Tax Substantiation Warning: Per 2026 IRS guidelines, donors are responsible for obtaining written acknowledgment from a charity for any single contribution of $250 or more before claiming a deduction. Tax benefits for charitable giving vary based on your filing status (Itemized vs. Standard Deduction) and your Adjusted Gross Income (AGI).

Past Performance: Any examples of tax savings or investment returns are for illustrative purposes only. Past performance does not guarantee future results.