Key Points:

- By hiring your children, you can shift business income to their lower tax bracket, effectively keeping more money in the family.

- For the 2026 tax year, the standard deduction allows a child to earn up to $16,100 without paying any federal income tax.

- Operating as a sole proprietorship or family partnership allows you to avoid Social Security and Medicare taxes on wages paid to your minor children.

Hiring your children is a strategic way to reduce your tax liability while building generational wealth. Here are six tax items to consider before you pull your kids into the family business.

1. Advantages of Hiring Your Children

The benefits of employing your family go beyond simple tax savings:

- Funding Future Savings: You can direct their salary toward a Roth IRA or a 529 Savings Plan. Since this is earned income, it can grow tax-free for decades.

- Deductible Business Expenses: When you are hiring your children, their wages are a fully deductible business expense, which reduces your company’s taxable net income.

- Building Real-World Skills: Employment instills lifelong values of hard work, discipline, and financial literacy.

2. IRS Compliance and Documentation

The IRS pays close attention to family payroll. To ensure your deductions are upheld, you must treat your child like any other employee:

- Legitimate Business Tasks: Assign them “ordinary and necessary” duties, such as administrative support, janitorial work, or digital marketing.

- Written Agreements: Maintain a clear job description and an employment contract.

- Accurate Record-Keeping: Use timesheets to track hours worked and tasks completed to prove the wages were actually earned.

- Official Filings: You must issue a W-2 to your child and file Form W-3 with the Social Security Administration by the required deadlines.

Note: Before you hire your children, discuss your state’s payroll tax with your tax advisor. This includes staying compliant with state-level income and payroll taxes, as well as the legal distinctions used to classify workers as either independent contractors or employees.

3. Reasonable Compensation

Your child must receive “reasonable” pay—meaning the same rate you would pay a stranger for the same work. While you cannot pay a five-year-old $100 an hour to shred paper, you can pay a teenager a competitive market rate for managing your business social media accounts.

Staying within these bounds keeps your strategy IRS-compliant.

4. 2026 Tax Rules and Limits

In 2026, the standard deduction for a single filer is $16,100. This means your child can earn up to this amount and typically owe $0 in federal income tax.

- Tax Example: William is 16. His mother claims him as a dependent on her income tax return. He worked part time on weekends during the school year and full time during the summer. He earned $16,700 in wages. He didn’t have any unearned income (e.g. investment income) and no itemized deductions. He must file a tax return and pay tax on $600 of taxable income ($16,700 – $16,100).

- Zero Tax Example: If William earned $15,500 in 2026, he would pay no federal tax because his earned income is less than $16,100.

Even if your child owes zero tax, you may want them to file a return as this is the only way to get a refund for any federal or state income taxes that were withheld from their paychecks.

Note: While earned income is taxed at the child’s rate, remember that “unearned income” (like dividends or interest) over a certain threshold may be subject to the Kiddie Tax.

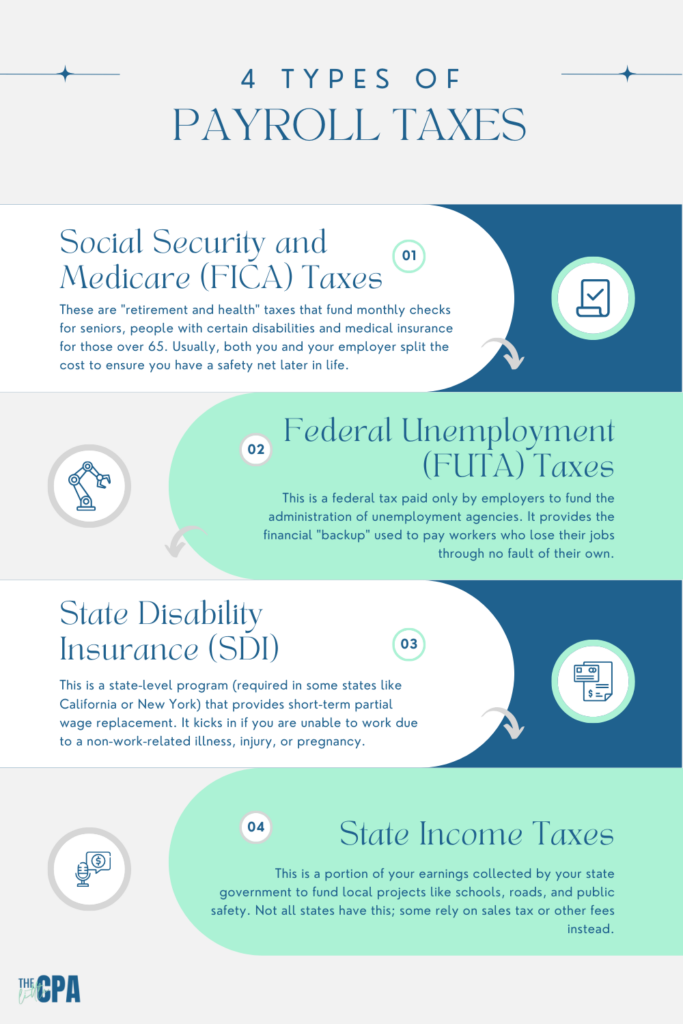

Payroll Tax Exemptions

The way your business is organized determines which payroll taxes you need to pay on behalf of your employed child:

- Sole Proprietorships & Family Partnerships: If the business is a sole proprietorship or family partnership owned entirely by the parents, wages paid to a child under age 18 are exempt from Social Security and Medicare (FICA) taxes. Additionally, wages paid to a child under age 21 are exempt from Federal Unemployment (FUTA) taxes.

- Corporations (S-Corp or C-Corp): If your business is incorporated, the child’s wages are subject to FICA and FUTA taxes, regardless of age. However, the business still gets the benefit of the wage deduction.

5. College Financial Aid

A child’s earned income can impact their financial aid eligibility. It is important to balance the immediate tax savings of hiring your children with long-term goals for college aid.

Is This the Right Move for Your Business?

The decision to hire family involves both financial and legal considerations. While the tax benefits are substantial, you should consult with a business attorney, wealth advisor and tax professional to ensure you are following labor and tax laws, including state-specific minimum age requirements and workers’ compensation rules.

Disclaimer: This material is for informational purposes only and is not intended as tax, legal, or accounting advice. Consult your own advisors before making significant financial commitments.

General Information Only: This content is prepared by The Little CPA for informational and educational purposes only. It does not constitute financial, tax, legal, or investment advice. While we strive for accuracy, the rapidly changing nature of tax laws—means this information may not apply to your specific situation.

No Professional-Client Relationship: Your use of this website or engagement with this content does not create a CPA-client relationship. You should consult with a qualified professional who is familiar with your individual financial circumstances before making any significant financial decisions.

Spiritual & Personal Autonomy: Discussions regarding church financial health and Biblical stewardship are intended to provide a framework for evaluation and are not a substitute for personal prayer, discernment, or spiritual counseling. The Little CPA does not endorse or guarantee the financial stability of any specific religious institution. Choosing a place of worship is a deeply personal decision that involves factors far beyond financial metrics.

Third-Party Risk: References to specific software, banks, or storage providers are not endorsements. We are not liable for any issues, data breaches, or financial losses that may arise from your engagement with third-party vendors.

Tax Substantiation Warning: Per 2026 IRS guidelines, donors are responsible for obtaining written acknowledgment from a charity for any single contribution of $250 or more before claiming a deduction. Tax benefits for charitable giving vary based on your filing status (Itemized vs. Standard Deduction) and your Adjusted Gross Income (AGI).

Past Performance: Any examples of tax savings or investment returns are for illustrative purposes only. Past performance does not guarantee future results.