______________________

______________________

Key Takeaways from I Will Teach You to Be Rich:

- The book is a practical resource for early and mid-career individuals looking to improve their personal finances.

- It offers actionable steps for making real changes in one’s financial life, with a focus on investing, conscious spending, automation and low-fee banking options.

- The book taps into the psychology of money and helps readers define their own “rich life,” while providing relatable examples and a persuasive writing style.

______________________

I Will Teach You to be Rich by Ramit Sethi is an excellent resource for early and mid-career individuals looking to take control of their personal finances.

Those who are physically or systemically unable to grow their income may not find as much practical advice in this book.

High net worth individuals may also need more advanced knowledge on estate planning, investment management, and tax planning after reading this book.

However, employees or early business owners who make a livable wage, are in a position to earn more income, and have time to take advantage of the market for long-term growth may find this book helpful.

Is I Will Teach You to be Rich Practical?

One of the best features of this book is its practicality.

Each chapter provides actionable steps to help you make real changes in your life.

In fact, before diving into the book, make sure to have your bank accounts and budget open for reference!

Here are a some practical takeaways from a few chapters in the book –

Get Ready to Invest

Get Ready to Invest

In the chapter “Get Ready to Invest,” Ramit offers six systematic steps that are helpful for individuals who are scared and don’t know where to start when it comes to investing. These steps build on each other and can be automated. For busy, working professionals, this is keen advice.

He also shares password manager recommendations that will keep your financial information secure, a tip you won’t find in many other best-selling personal finance books.

Conscious Spending

In the chapter on “Conscious Spending,” Ramit provides practical knowledge by advising readers to incorporate stupid mistakes into their spending plan. To encourage proactive financial management, he also encourages readers to plan ahead for how “stupid mistake” funds will be spent if no mistakes are made (shout out to anyone who can achieve their personal finance goals sans stupid mistakes!)

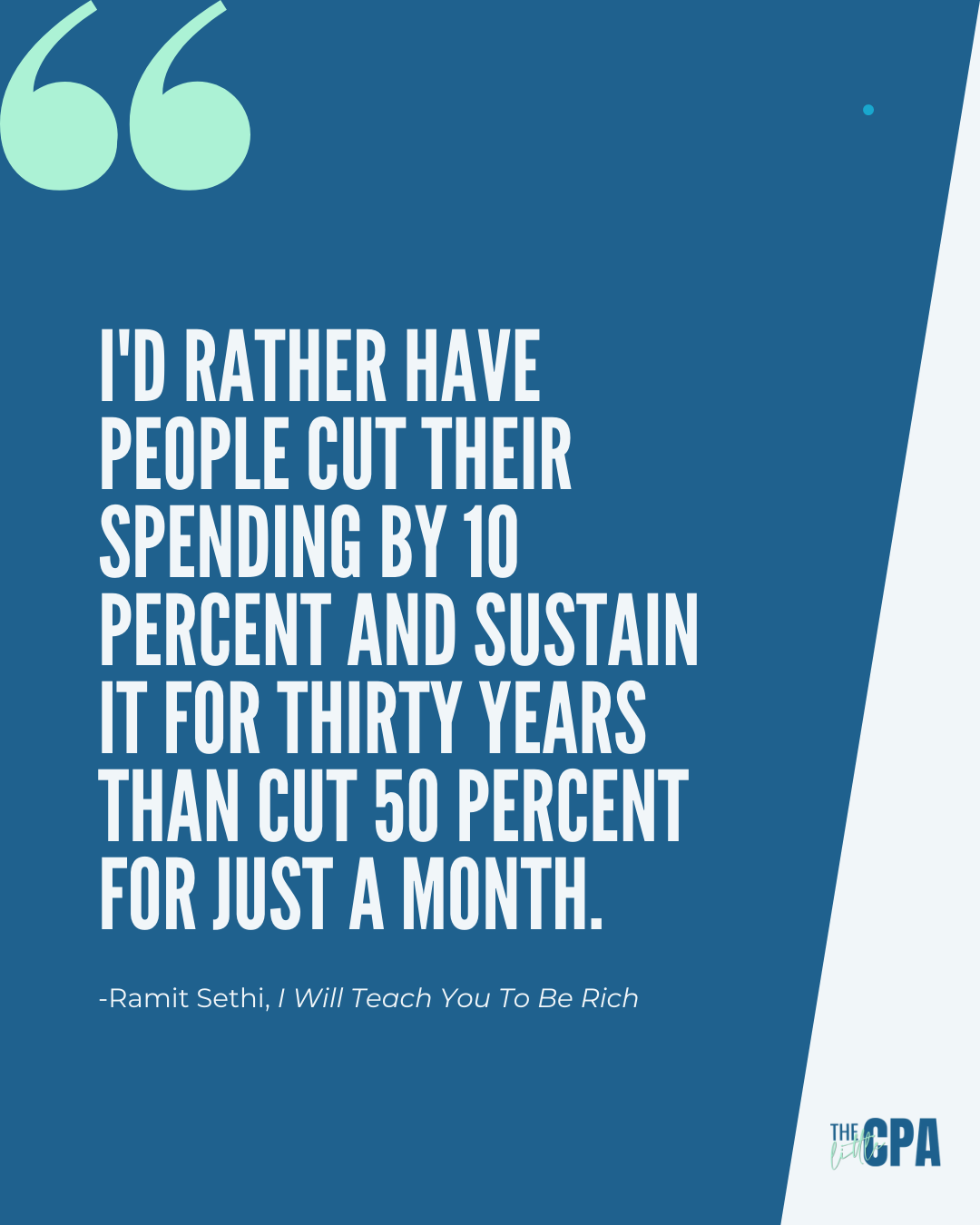

Moreover, he encourages conscious spending by sharing how he considers incremental wins in spending to be big wins. This encouragement is a practical way to stay motivated on your financial journey. He drives his point home by stating that he would “rather have people cut their spending by ten percent and sustain it for thirty years than cut fifty percent for just a month.”

Beat the Banks

What makes this book even more practical is how he shares his personal experience.

By sharing his firsthand experience using Schwab and Vanguard, Ramit effectively highlights the practical benefits of these institutions for readers who may be searching for low-fee banking options.

Ramit’s emphasis on the low fees offered by these banks is particularly valuable, as many readers may not be aware of the impact that fees can have on their overall financial well-being. By providing concrete examples from his own experience, Sethi makes it clear to readers that choosing a bank with lower fees can have a significant impact on their long-term financial health.

Is it Accurate?

Despite having an entire chapter that explains why you don’t need a financial advisor (provoking all licensed financial professionals to give the side eye), the content in I Will Teach You To Be Rich is quite accurate.

Regardless of his strong opinions (and a few controversial takes), Ramit does a decent job acknowledging the areas of personal finance that are not absolute. In fact, in the chapter “The Myth of Financial Expertise,” Ramit not only shares when to avoid financial advisors, but he also shares three exceptions when you should hire them (yes, he shares these exceptions in his “How to Get Rich” Netflix series as well!).

Regardless of his strong opinions (and a few controversial takes), Ramit does a decent job acknowledging the areas of personal finance that are not absolute. In fact, in the chapter “The Myth of Financial Expertise,” Ramit not only shares when to avoid financial advisors, but he also shares three exceptions when you should hire them (yes, he shares these exceptions in his “How to Get Rich” Netflix series as well!).

By sharing exceptions to his own advice, he provides readers with a well-rounded perspective.

He also backs up his financial advice with qualified data. In particular, when discussing student loans, Ramit backs up his belief that college will be one of the best investments you ever make with data showing how the average bachelor’s degree holder earns over $1 million more than those with only a high school diploma.

Is it Compelling?

The strength of Ramit’s book lies in his ability to tie in the psychology of money – which makes sense since he holds a Bachelors of Science in Psychology from Stanford.

Tapping into the psychology of each reader’s unique needs and wants, he encourages readers to define their “rich life” for themselves. Once the reader defines their rich life, they are motivated to receive his advice to achieve their goal.

In short, this psychological aspect is what makes “I Will Teach You To Get Rich” such a compelling and valuable resource for anyone looking to improve their financial well-being.

Does I Will Teach You To Be Rich have a Unique Writing Style?

I Will Teach You To Be Rich has a persuasive writing style that makes the book’s messaging very clear.

Ramit’s straight-forward personality, charisma and witty humor bleed through the pages, keeping you engaged and wanting to know more.

Having said that, his assertive messaging could be a turn off for some.

The strong opinions (and some foul language) displayed throughout the book aren’t for everyone…depending on your background and personality, you’ll either love his messaging or hate it!

Is it Relatable?

Two components that make this book uniquely relatable are the use of real world examples and discussion of money and relationships.

Real World Examples

In the second edition of the book, Ramit shares real world examples that make each point understandable and relatable.

For instance, in the chapter “Optimize Your Credit Cards,” Ramit shares quotes from readers who struggled with fear and anxiety around debt. Ramit provides knowledge to combat this fear by teaching readers how to optimize their credit cards via negotiation.

Relationships

One of the most relatable parts of this book is his discussion on how to talk about money in relationships. And by relationships, he doesn’t just touch on romantic relationships. He discusses friendships as well – an area often overlooked in personal finance books.

One helpful piece of advice he shared for readers working towards their personal finance goals is to consider context before sharing how much money you have with others. He says, “to someone who earns $60,000, telling them you’re on track to have a $1 million portfolio (or much more) doesn’t communicate safety and security. It communicates arrogance.”

The entire book is filled with real world advice and examples that touch on real life financial struggles for which Ramit provides a solution.

Final Review

This book is a valuable resource for readers looking to improve their financial well-being through actionable advice based on real-world experience.

From credit card optimization to investing to signing a prenup, early and mid-career professionals can immediately put his advice into action while reading the book.

Keep in mind that, although most of the messaging in this book is on point, Ramit does have some controversial takes on personal finance. Some of those takes include –

- Most people don’t need a budget (he recommends Conscious Spending instead).

- When it comes to finances, most people are mostly the same.

- Financial advisors should charge by the hour and not as a percentage of assets under management.

- Renting is actually a smart decision for many people.

In spite of his controversial takes, Ramit’s real world examples and personal experience add a valuable layer of authenticity and credibility to his advice and recommendations.

By sharing his own successes and failures (his Indian insights are a real treat!), he demonstrates that the strategies he suggests are not just theoretical, but have been put into practice and proven effective.

I Will Teach You To Be Rich gets 5/5 Tick Marks from The Little CPA ✓

Click here to purchase a copy of the book for yourself!

For more personal finance book recommendations, visit The Little CPA’s Best Money Books!

Disclaimer: The Little CPA’s blog provides book reviews of financial literature for informational purposes only and is not intended to be and should not be relied upon as financial advice. The views and opinions expressed in these reviews are those of the authors and do not necessarily reflect the official policy or position of The Little CPA. Readers are strongly encouraged to seek the advice of a licensed financial advisor before making any financial decisions. The Little CPA is not responsible for any losses, damages, or other liabilities that may arise from reliance on information contained in the book reviews on this blog.