Key points:

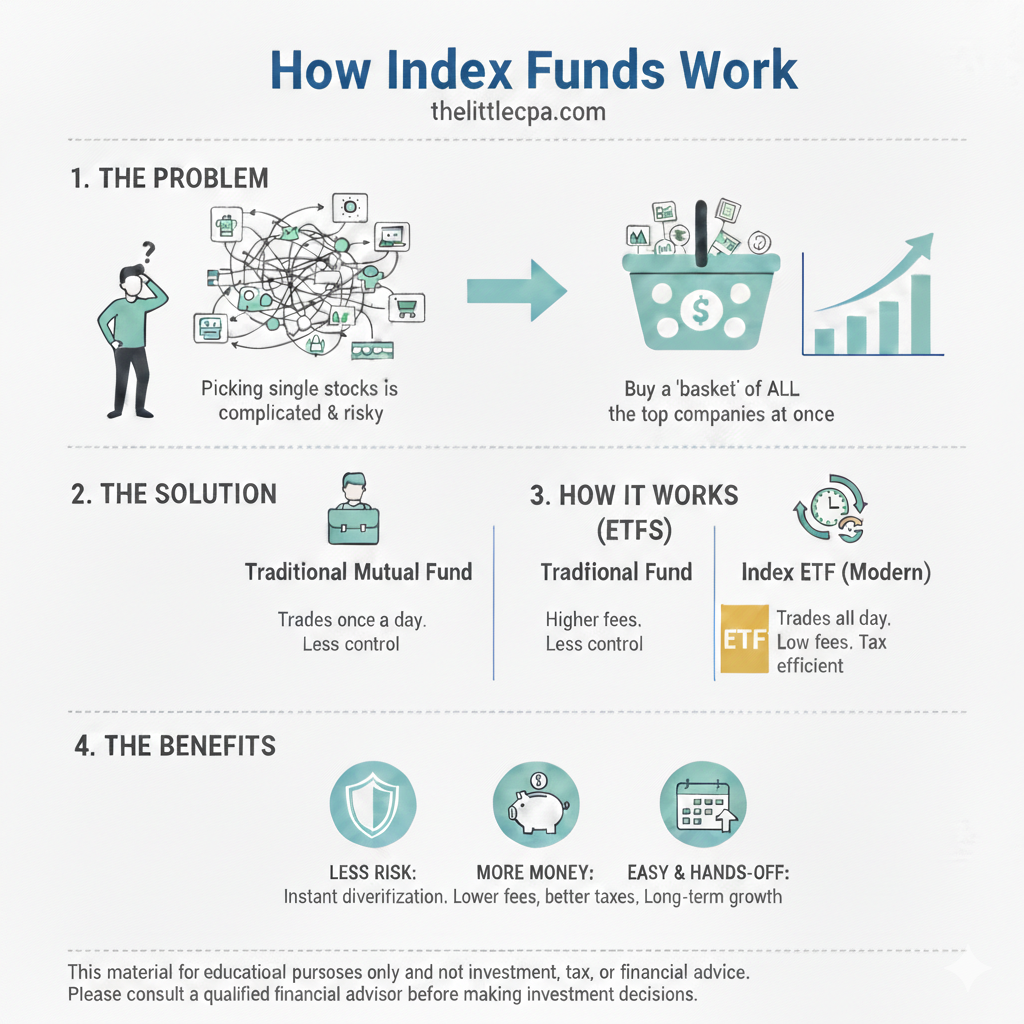

- Investing in index funds allows you to own a diversified “basket” of securities rather than risking your capital on a single stock.

- These funds offer a passive, low-cost alternative to actively managed funds by simply matching the performance of a specific market index.

- Most modern investors choose between index mutual funds and ETFs based on their preference for trade flexibility and investment minimums.

Nearly a quarter of all U.S. household financial assets are held in index funds. This upward trend continues into 2026 as more people recognize the long-term value of a “set it and forget it” strategy.

While no investment is entirely immune to loss, the historical performance and risk management of these funds put many conservative investors at ease.

Understanding the Core Definitions

Before you dive into investing in index funds, you must understand a few fundamental terms.

- Market Index: This is a “basket” of securities that represents a specific sector of the market. Common examples include the S&P 500 (large companies), the Russell 2000 (small companies), and the Nasdaq (tech-heavy).

- Index Funds: As defined by the SEC, these funds seek to track the returns of a specific market index. If a stock is like a single box of cereal, an index fund is like the entire cereal aisle. An index fund can be a mutual fund or an exchange traded fund (ETF).

Index Mutual Funds

In simple terms, these are “unlimited” funds. Think of them like a giant basket that can grow as big as needed—every time someone wants to join, the fund simply creates a new spot for them.

A professional manager runs the fund and makes sure it holds a little bit of every company in a specific list (like the “Top 500 Companies”). Instead of trading with other people on a stock market apps, you buy and sell directly through the company that owns the fund.

Because of this, the price isn’t constantly jumping around. It is calculated just once a day after the markets close, so everyone who bought or sold that day gets the exact same price.

Capital Gains Tax

When you invest in a traditional mutual fund, the manager often has to sell stocks to raise cash whenever other investors decide to sell their shares. These sales can trigger “capital gains taxes” for everyone in the fund, meaning you might owe the IRS money even if you didn’t sell anything yourself.

Exchange Traded Funds (ETFs)

Think of a mutual fund like a movie ticket you can only buy or return at a set price after the theater closes for the night. An ETF is more like a concert ticket being traded on a site like StubHub, where the price changes every second and you can buy or sell it whenever you want while the show is running.

While they can track the same indexes as mutual funds, they offer several distinct advantages:

- Intraday Trading: Unlike mutual funds, ETF shares trade like individual stocks on an exchange. This means prices fluctuate throughout the day, allowing you to buy or sell at any moment during market hours. Frequent traders tend to prefer ETFs over index mutual funds.

- Tax Efficiency: ETFs use a unique “in-kind” exchange process that allows them to move stocks in and out without selling them for cash. Because the fund avoids selling assets on the open market, it doesn’t create those surprise tax bills for you, making it a much more tax-efficient way to grow your wealth.

Actively Managed Funds

Unlike index funds, actively managed funds employ a professional team to hand-pick stocks in an attempt to “beat the market.”

In an actively managed fund, a professional stock-picker (the “manager”) is constantly researching and trying to time the market to beat everyone else. In an index mutual fund, the manager has a much simpler job: they are basically on “autopilot,” instructed to match a specific list of companies (like the S&P 500) exactly.

To determine if the fund is index-based or actively managed, look at the “Management” section of the prospectus or the fund name; an index fund will explicitly name a benchmark it is “tracking” (like the S&P 500), whereas an active fund will state its goal is to “seek” or “outperform” the market through professional selection.

Investing in Index Funds

Investing in index funds simplifies the path to long-term wealth by removing the guesswork of picking individual stocks. This passive approach remains a foundational strategy for anyone looking to build a resilient, hands-off portfolio.

Learn more about investing in index funds in our interview with Chelsea Ransom-Cooper, CFP® .

Disclaimer: This material is for informational purposes only and is not intended as tax, legal, or accounting advice. Consult your own advisors before making significant financial commitments.

General Information Only: This content is prepared by The Little CPA for informational and educational purposes only. It does not constitute financial, tax, legal, or investment advice. While we strive for accuracy, the rapidly changing nature of tax laws—means this information may not apply to your specific situation.

No Professional-Client Relationship: Your use of this website or engagement with this content does not create a CPA-client relationship. You should consult with a qualified professional who is familiar with your individual financial circumstances before making any significant financial decisions.

Third-Party Risk: References to specific software, banks, or storage providers are not endorsements. We are not liable for any issues, data breaches, or financial losses that may arise from your engagement with third-party vendors.

Tax Substantiation Warning: Per 2026 IRS guidelines, donors are responsible for obtaining written acknowledgment from a charity for any single contribution of $250 or more before claiming a deduction. Tax benefits for charitable giving vary based on your filing status (Itemized vs. Standard Deduction) and your Adjusted Gross Income (AGI).

Past Performance: Any examples of tax savings or investment returns are for illustrative purposes only. Past performance does not guarantee future results.