Navigating nonprofit compliance can be complex, with numerous federal and state requirements that organizations must meet to maintain their legal and financial standing.

But fear not!

We’ve got you covered with a comprehensive list of resources to help your nonprofit thrive while staying compliant with legal and accounting obligations.

Let’s dive in and empower your nonprofit for success!

1. Request an EIN

An Employer Identification Number (EIN) enables a nonprofit to open a bank account, process employee payroll and taxes, acquire insurance, and enter into certain contracts.

Furthermore, many grant providers require organizations to have an EIN in order to apply for funding, meaning it is essential for nonprofits seeking additional financial support.

You can apply for an EIN on IRS.gov.

2. Open a Separate Bank Account

Opening a dedicated bank account is a prudent practice for nonprofits to ensure proper financial management, compliance, and transparency.

A separate bank account also aids in maintaining compliance with legal and regulatory requirements, including proper record-keeping, financial reporting, and audit processes.

3. Establish Board of Directors

3. Establish Board of Directors

Nonprofits are legally required to establish a Board of Directors in order to ensure proper oversight and compliance with relevant laws, regulations, and ethical standards.

A Board of Directors provides the governance structure for a nonprofit organization, ensuring that executive decisions are made according to legal parameters and have the best interests of the organization’s mission at heart.

This board is also responsible for the following –

- monitoring finances,

- approving budgets and plans for the future,

- reviewing nonprofit policies and procedures,

- advocating for the community served by the organization,

- and other important duties as outlined in their governing documents.

4. Hire a Nonprofit Attorney

Attorneys are the most qualified to assist your nonprofit with obtaining tax-exempt status as well as all other compliance matters.

Here is a list of attorneys committed to the nonprofit sector:

5. Prepare Your Organizing Documents and Policies

Nonprofit attorneys can help nonprofit founders prepare required and recommended legal documents including –

- Articles of Incorporation,

- ByLaws,

- Conflict of Interest Policies,

- Whistleblower policies,

- Employment Contracts,

- Document Retention policies,

- and other organizational documents.

Click here to check out a few sample templates for several nonprofit policies.

6. Download the Form 1023 Checklist

What do you need to file your Tax-Exempt Application?

The last two pages of the Form 1023 clearly outline everything you need.

Click here and scroll to pdf pages 27-28.

7. Know Your State’s Filing and Compliance Requirements

Every state has unique filing and compliance requirements.

The states govern how many Board of Directors your organization needs, what language should be included in your Articles of Incorporation and other legal and compliance items.

In some states, every nonprofit that solicits charitable funds within the state must file an annual form and pay a fee.

For a list of each state’s filing requirements, click here.

8. Get Familiar with StayExempt.Org

The IRS has a website devoted to federal nonprofit compliance.

The IRS has a website devoted to federal nonprofit compliance.

Click here to learn how to maintain your tax-exempt status, avoid unrelated business income, lobby within limits and more!

9. Know Which Form 990 to File for Tax Compliance

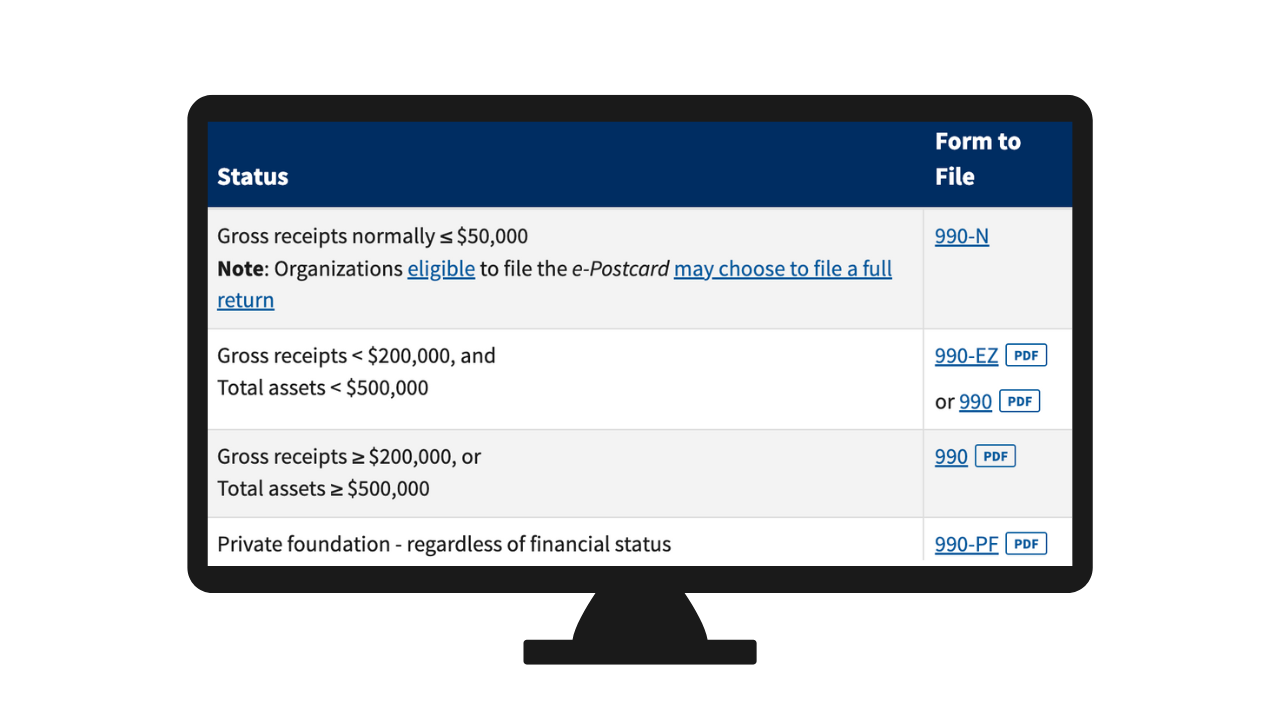

Nonprofits formed in the United States are generally required to file Form 990, which is the annual information return, with the Internal Revenue Service (IRS).

The first Form 990 is typically due by the 15th day of the 5th month after the end of the organization’s tax year. However, if a nonprofit fails to file Form 990 for three consecutive years, it may lose its tax-exempt status with the IRS.

The Form 990 series includes several variations, such as Form 990-EZ for smaller organizations, Form 990-PF for private foundations, and Form 990-T for organizations with unrelated business income.

For more information, see IRS Publication 4839.

10. Purchase Insurance

To protect the organization from potential liabilities, nonprofit founders should consider purchasing various types of insurance.

In addition to Directors and Officers (D&O) Insurance, nonprofit Directors should speak with an attorney about general liability coverage and other types of insurance that might be necessary for the organization.

Each type of coverage offers different levels of protection from certain risks associated with operating a nonprofit organization.

11. Monitor Public Support Percentage

Did you know nonprofits are required to get a certain percentage of their support from the “public?”

The IRS website provides an in-depth explanation of the two types of public support tests nonprofit executives should be familiar with.

The IRS website provides an in-depth explanation of the two types of public support tests nonprofit executives should be familiar with.

Per the IRS instructions, certain nonprofits classified under IRC 501(c)(3) must maintain a public support percentage of at least 33.33% over a five-year period to avoid being classified as a private foundation, which is subject to additional regulations and excise taxes.

Additionally, certain nonprofits, such as churches and schools, are exempt from the public support test and are not required to maintain a specific public support percentage.

12. Check IRS Master File

Did you know the IRS has a public record of every nonprofit in your state? They extract data monthly to update the Master File.

The record discloses the nonprofit’s Name, EIN, Accounting Period, Activity Code and more. Once your tax-exempt status is approved, click here to access the file and review your classification.

13. Apply for Property Tax or Sales Tax Exemption

Many cities and localities provide property and sales tax exemption for nonprofits.

Nonprofits should proactively apply for property and sales tax exemption in their region if it is allowed, as it can significantly impact their financial resources and operational sustainability.

Property tax exemption can result in substantial cost savings, freeing up resources that can be directed towards furthering the nonprofit’s mission

Sales tax exemption can also provide savings on purchases made by the nonprofit, reducing operational expenses

14. Join Your State Nonprofit Association

For many nonprofits, their state nonprofit association is their most helpful compliance resource.

The National Council of Foundations created a map that provides the name and contact information for almost every state’s nonprofit association. Click here.

15. Track Donations

It is important for nonprofits to keep track of the name, address and amount given by each donor.

It is important for nonprofits to keep track of the name, address and amount given by each donor.

Below is a list of common types of software used to track donations:

- Microsoft Excel (for small nonprofits)

- Quickbooks for Nonprofit

- Blackbaud Raiser’s Edge

- DonorPerfect

16. Create a System for Donor Acknowledgement

Thanking donors isn’t just a nice thing to do, it is legally required for donations greater than $250.

Accurate donor acknowledgement letters should be timely prepared to ensure compliance with tax regulations and maintain positive donor relationships.

The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information:

- name of the organization;

- amount of cash contribution;

- description (but not value) of non-cash contribution;

- statement that no goods or services were provided by the organization, if that is the case;

- description and good faith estimate of the value of goods or services, if any, that organization provided in return for the contribution; and

- statement that goods or services, if any, that the organization provided in return for the contribution consisted entirely of intangible religious benefits, if that was the case.

17. Determine NAICS Code

Establishing a North American Industry Classification System (NAICS) code can be crucial for nonprofits for several reasons.

First, many grant applications and funding opportunities require nonprofits to provide their NAICS code, which is used to classify their industry or sector.

Second, having an appropriate NAICS code can aid in data reporting and benchmarking efforts, allowing nonprofits to compare their performance with similar organizations in their industry or sector.

Finally, the NAICS code can be used for tax reporting purposes, helping nonprofits correctly identify their industry or sector when filing for tax-exempt status or completing other tax-related obligations.

18. Understand and Complete Grant Compliance Requirements

Prioritize understanding and meeting grant compliance requirements to maintain accountability, ensure proper use of grant funds, and maintain positive relationships with grantors.

Prioritize understanding and meeting grant compliance requirements to maintain accountability, ensure proper use of grant funds, and maintain positive relationships with grantors.

Grant compliance requirements typically include specific guidelines, restrictions, and reporting obligations that nonprofits must adhere to in order to receive and retain grant funding. This may involve –

- submitting expenditure responsibility reports, which provide detailed documentation of how grant funds are spent, and

- demonstrating compliance with financial audits to ensure the proper use of funds.

19. Find a Nonprofit Accountant for Nonprofit Compliance

It is important for nonprofit leaders to work with a qualified accountant to set up payroll, keep financial records and prepare annual returns.

Here are a few qualified accounting organizations who specialize in tax-exempt organizations –

- Moss Adams,

- Charity Accounting,

- Jitasa Group,

- Evergreen Alliance,

- The Visionary Accounting Group,

- CNRG Accounting Advisory, LLC or

- your regional or national CPA firm.

Be sure to ask the firm about their nonprofit practice and whether they are familiar with your type of nonprofit.

20. Have Regular Board Meetings and Document Minutes

In some states, there may be specific laws or regulations that mandate a certain number of board meetings per month or year.

Regular nonprofit board meetings and documenting minutes are crucial for effective governance and compliance with legal requirements.

Documenting minutes, which are official records of board meetings, serves as evidence of the board’s actions, decisions, and deliberations. Minutes provide a historical record that can be referenced in the future to ensure accountability, transparency, and compliance with the nonprofit’s bylaws and other legal requirements.

21. Obtain Business License, if Necessary

In some cities, nonprofits are required to obtain a business license to legally operate within the city’s jurisdiction.

This requirement may apply to nonprofits that engage in business activities, such as selling goods or services, renting property, or conducting fundraising events.

The purpose of this requirement is to ensure that nonprofits comply with local regulations and contribute to the local economy.

Obtaining a business license typically involves submitting an application, paying a fee, and meeting specific requirements, such as providing proof of insurance or meeting zoning regulations. Failure to obtain a required business license can result in fines, penalties, and legal repercussions.

Why Nonprofit Compliance is Important

In conclusion, compliance with nonprofit requirements is a critical aspect of effective nonprofit management.

From maintaining tax-exempt status to adhering to grant compliance requirements, understanding and meeting these obligations are essential for nonprofits to operate responsibly, transparently, and sustainably.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice.

This business and websites listed are not endorsed by The Little CPA.

You should consult your own tax, legal and accounting advisers before engaging in any transaction.