The Power of Charitable Remainder Trusts (CRTs) in High-Interest Rate Environments – Key Takeaways:

- CRTs are designed to convert highly appreciated assets (stocks, bonds, etc.) into a stream of income without immediate tax liability.

- CRTs offer a reliable income stream, tax benefits, efficient wealth transfer, and increased philanthropic impact, especially in high-interest rate environments.

- Despite their considerable benefits, CRTs also have limitations such as being irrevocable, substantial initial funding requirements, and strict transaction provisions.

If you identify as a social entrepreneur, philanthropist, impact investor or other type of charitable change-maker, you want to know about Charitable Remainder Trusts (CRTs).

Although CRTs normally make the most sense when you reach ultra-high-net-worth, it’s important to be aware of them now.

Why?

If you plan to sell a business, sell highly appreciated assets (if you bought Amazon shares in the early days… listen up!), maximize all of your retirement savings options or engage in some future transaction that will significantly increase your net worth, you’ll want to have this tool handy.

Here’s why it should be on your radar, especially in high-interest rate environments.

Key Players in CRTs

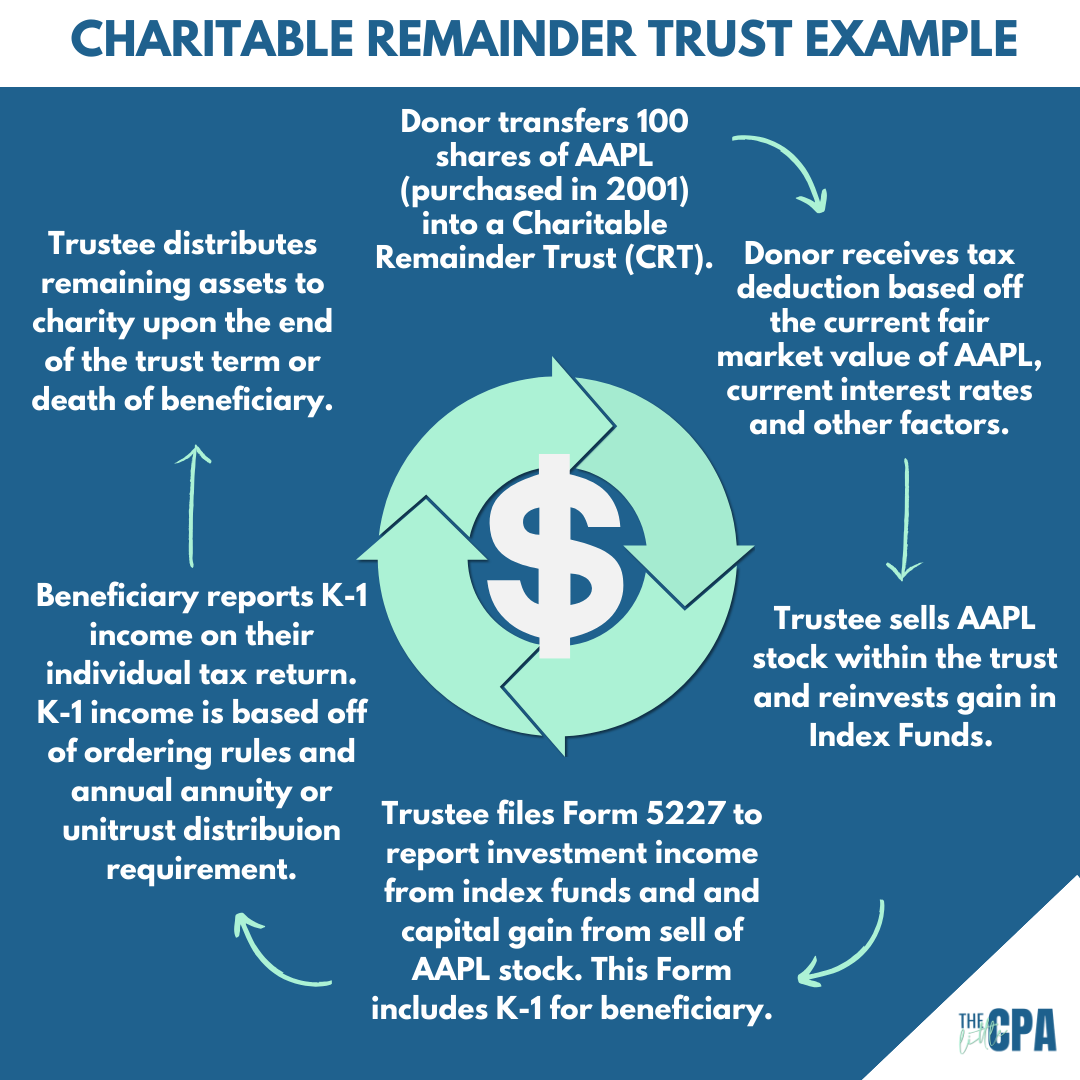

A CRT involves four primary players: the donor, trustee, beneficiary, and charitable beneficiary.

Donor: You, as the wealth creator, transfer highly appreciated assets such as stocks, real estate, or other investments into an irrevocable trust.

Trustee: A trustee (often a bank or trust company) manages the assets within the trust.

Beneficiary: You or your chosen beneficiaries (such as yourself and your spouse) receive regular payments from the trust, typically for the rest of your life or a predetermined number of years.

Charitable Beneficiary: After the term or upon your passing, the remaining assets in the trust are donated to one or more qualified charitable organizations of your choice.

How Beneficiaries Get Paid

Now that you understand how a CRT works, let’s discuss how the non-charitable beneficiary gets paid.

The way it works is, the trust’s income – interest, dividends, gains on sale of stock, etc. – is paid to the beneficiary over the trust’s term.

That means, if the trust is created to last twenty years, then the trust’s income is paid out to the beneficiary over a twenty year term.

Or, if the trust is created to last over the beneficiary’s lifetime, the beneficiary will get paid over the remainder of their life.

Let’s say you decide to create a charitable remainder trust with a lifetime term. If you sale stock within the trust for a gain of $1 million in Year 1, that $1 million taxable gain will be paid to you over your lifetime.

Note: Most charitable remainder trust terms cannot exceed 20 years, even if created to last during the beneficiaries lifetime. For more info, check out the IRS’ website.

Of course, the trust terms are more complicated than that, but hopefully you get the idea!

Annual Distribution

A charitable trust’s annual distribution requirement dictates how much income must be distributed to beneficiaries each year.

Annuity Trust

For a charitable remainder annuity trust, beneficiaries receive a fixed annual payment, typically set at the trust’s inception.

So, let’s say you transfer stock into charitable remainder annuity trust (CRAT) and, per the annuity calculation, you are to receive $10,000 of the CRAT’s investment income every year. Even if the value of the stock triples or doubles, your annual distribution would be limited to $10,000.

This consistent payout offers stability but doesn’t adjust for changes in trust assets.

Unitrust

In contrast, a charitable remainder unitrust distributes a percentage of the trust’s fair market value annually.

So, let’s say you place stock into a charitable remainder unitrust (CRUT), and the annual distribution (unitrust amount) is 5% of the fair market value of assets as of January 1st each year. In 1 year, your distribution might be 5% of $1 million. In another year, your annual distribution could be 5% of $800,000 – depending on how your trust assets perform in the market.

This provides flexibility as beneficiaries potentially benefit from the trust’s growth, but their income may vary depending on the trust’s performance.

Income Ordering Rules

Form 5227, the form your tax professional completes to report your CRT’s annual income to the IRS, outlines important ordering rules for charitable remainder trusts.

When distributing income to beneficiaries, these rules establish a clear hierarchy.

Ordinary Income

First, ordinary income takes priority as the first tier, ensuring that beneficiaries receive their entitled taxable income. So, if the trust incurred interest or business income, that type of income is getting paid out to the beneficiary first.

Capital Gains

Second, capital gains are distributed as the second tier. Any stock sold within the trust will be distributed to the beneficiary as capital gains after all ordinary income has been distributed.

Tax-Exempt Income

Finally, tax-exempt income represents the third tier. Municipal bonds, U.S. Treasury bonds and other types of tax-exempt assets are included in this tier.

Understanding these ordering rules is crucial for both trustees and beneficiaries to ensure efficient and compliant income distribution. To learn more about CRT four tiers of income, check out PG Calc.

The Power of Charitable Remainder Trusts (CRTs) in High-Interest Rate Environments

Pros:

Income Stream: CRTs provide a reliable income stream, often based on a fixed percentage of the trust’s initial value (annuity trust) or the fair market value at the beginning of the tax year (unitrust).

Tax Benefits: You receive an immediate income tax deduction when you create the CRT, based on the present value of the future charitable donation. In a high-interest rate environment, this deduction can be more substantial.

Wealth Transfer: CRTs facilitate the tax-efficient transfer of wealth to your beneficiaries and charitable causes, potentially reducing estate taxes.

Philanthropic Impact: High-interest rates can boost the ultimate donation to your chosen charitable organizations, allowing you to make a more significant impact on the causes you care about.

Cons:

Irrevocable Nature: Once assets are placed in a CRT, they are irrevocable. You cannot change the terms or reclaim the assets.

Complexity and Costs: Setting up and managing a CRT can be complex and may involve legal and administrative costs.

Minimum Funding Requirement: CRTs typically require a substantial initial contribution, making them less accessible to those with limited resources.

Private Foundation Provisions: Not every type of appreciated asset can be placed into a CRT. For example, if you want to put a debt-financed long-term rental property into the CRT, you could be subject to a 100% unrelated business income tax (UBIT) on any rental income incurred on the property. You can learn more about CRT’s strict compliance provisions on the IRS’ website.

Income Variability: While CRTs offer income, the payments for Charitable Remainder Unitrusts (CRUTs) are not fixed and may fluctuate based on the trust’s performance, which can create uncertainty.

The Power of Charitable Remainder Trusts (CRTs) in High-Interest Rate Environments: Conclusion

Your wealth can be a powerful force for positive change.

You may not be a multi-millionaire now, but if you own a business, regularly invest a significant amount of your income or will inherit assets from a loved one – you could be a candidate for CRTs sooner than you think.

By understanding and leveraging tools like CRTs, you can ensure your wealth serves not just you and your heirs, but also the broader community and causes you care about.

When interest rates are high, the potential benefits, such as increased income and tax advantages, make CRTs an attractive option.

Disclaimer:

The information provided on this blog is for educational and informational purposes only. While every effort has been made to ensure the accuracy and reliability of the content, we do not make any representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information.

Please note that the financial advice and information presented on this blog are not personalized to your specific financial circumstances. It is essential to consult with a qualified professional, such as a financial advisor or accountant, before making any financial decisions or taking any actions based on the information provided here.

We strongly encourage our readers to conduct thorough research and verification independently. The information on this blog should not be considered as financial, investment, or legal advice. Any reliance you place on the information provided is strictly at your own risk.

It is important to understand that any financial product or service mentioned or promoted on this blog may have its own risks and potential drawbacks. We advise our readers to carefully read the terms, conditions, and fine print associated with any product or service before making any investment decisions.