What comes to mind when you imagine a millionaire?

What comes to mind when you imagine a millionaire?

An athlete? A real estate mogul? An actress?… Maybe a YouTube influencer?

Well, how about a financial risk manager and a public health professional?

While these are respectable and well-paid careers, they are not what comes to mind when we think “millionaire.”

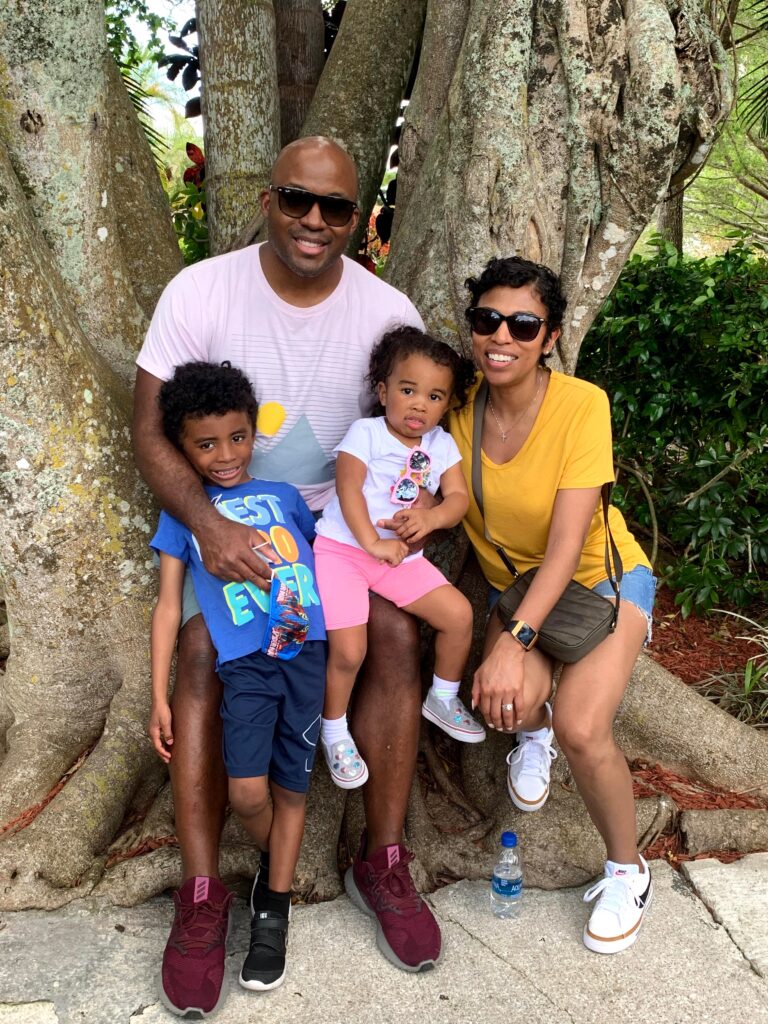

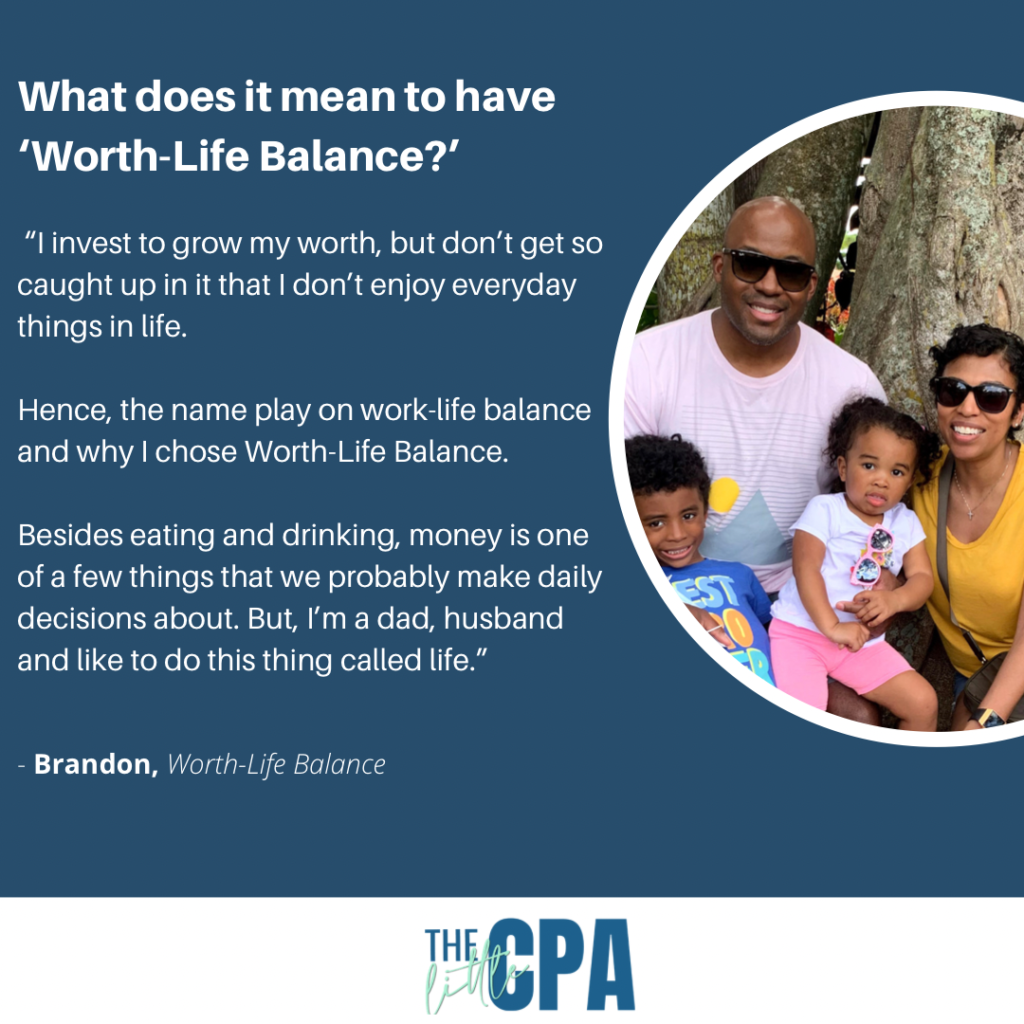

That’s why Brandon, creator of Worth-Life Balance, is such an inspiration. He loves his family. likes to travel, and he works a corporate job as a financial risk manager.

Relatable, right?

In the midst of living a “normal” life, he and his wife, a public health professional, have found a way to build a seven-figure net-worth.

Here is The Little CPA’s interview with the millionaire behind Worth-Life Balance –

__________________________

What was your financial position growing up?

“My mom had me at 20 years old.

We were on welfare early on and lived with my grandparents. My mom was still living at home when she became pregnant, as she was going to a community college.

Fortunately, it was never an abject poverty story.

I recall living at my grandparents’ house until kindergarten. We left our grandparents’ house because my mom got pregnant with my sister, and at that point she had to go learn to fly on her own, with my grandparents always there in the background.

My grandparents were 40 years older than me, so they were like second parents. A steel mill worker and a nurse, they also came from living in the housing projects to buying a house and starting a stronger future for their kids.

With my mom and grandparents, I had lots of love and general support. But, no one was in a position or knowledgeable about money. My grandfather didn’t know much, but he knew not to spend more than what you make.

He held onto Biblical principles and key tenets that we all know, but often don’t listen to.”

Since your family did not teach you how to manage money, how did you learn?

“I started to learn about money on my own.

I used to collect baseball cards as a kid, and my mom didn’t always have the money to buy the cards that I wanted. She suggested that I get a paper route. So, I did.

Part of the job was to deliver the papers. The other part was collecting the money.

I quickly learned about “the float’.

Basically, part of the money I collected was owed to the paper company. Because my boss didn’t come until maybe a week later for his money, if I was unable to collect from a customer, I would spend the boss’ money and then go collect money to pay him before he came knocking.

But, since I didn’t live in a wealthy area, one time a couple of customers were avoiding me. They were home with the lights on and not answering the door kind of thing to avoid paying. So when my boss came knocking on my door for his money, I turned off my TV and acted like I wasn’t home too.

After that, I became a saver.

I would get money and make it stretch. Skip the Jordan’s and buy classic Nike Cortez kind of a thing.

Even though I’m in a strong financial position today, I’m still pretty frugal and will balk at spending money on things that are unnecessary and won’t last.”

Ok, so somewhere in your story you upgrade from Saver to Investor. When did you start to invest?

“I really shifted into another gear after my wedding.

I wasn’t a single guy anymore who could spend his money on whatever I wanted. I was in a partnership and I wanted to create a family unit that I didn’t have growing up.

What is your investment strategy?

“We own only indexed mutual funds and indexed exchange-traded funds, and load up on them in many types of investment accounts.

I like things that get to a high-level result fast (like a 90% on a test), but I don’t spend inordinate amounts of time striving to get a 100%.

How do you choose your investments?

“Spending tons of time trying to do fundamental analysis to value stocks and create a portfolio of my own, trading options, etc. can be stressful.

Let’s take Peloton for example. If you invested in Peloton in 2020, things were good. But, fast forward a few months to 2021, you were down 50%.

If I have a gut conviction about a company or sector, I will pick a sector ETF that has a good amount of exposure to that company and tilt my portfolio in that direction. Other than that, I sleep well at night, stay invested for the long-term and try to think about how I’m going to withdraw money efficiently when I want to use it.”

What is your long term investment goal?

“Honestly, I just want to be rich.

Not because I want an expensive car or yacht. I just take pride in shaking up my branch on the family tree and directing it to grow in a new direction

I don’t want my kids to know what it’s like to live paycheck to paycheck. I want them rooted in knowing what struggling looks like and being compassionate towards it, but I’m fine if they never experience it.

I mean, who really enjoys not being able to do things that you want to do because of a lack of money?”

At what net worth position do you plan to achieve financial freedom?

“My plan is to reach $5M in net worth by 2030.

This would put us in a strong position to simply live life on our terms. I’m not sure that would mean that one or both of us retire, but to be able to go to work and if they fire you, you aren’t worried.

I want to live that kind of freedom”

You are also savvy with credit card points. Why do you believe in maximizing credit card benefits?

“To me personal finance is holistically having good money habits and leveraging the benefits that come along with it.

I got into credit card points and miles by accident. I had a card from college, but never really thought much of it. But, after I got married, I was looking to go on a vacation and save money on hotels. I stumbled across an article on leveraging credit cards to earn points to pay for travel.

I got into credit card points and miles by accident. I had a card from college, but never really thought much of it. But, after I got married, I was looking to go on a vacation and save money on hotels. I stumbled across an article on leveraging credit cards to earn points to pay for travel.

The rest is history.

I’ve traveled to five continents and around 20 countries, so far. Almost all of them using points and miles to keep cash in my pocket.

If you can be disciplined in your spending and pay off your balances to not pay interest, then there are credit cards that can reward you for those good financial habits.”

What books and resources did you use to learn more about personal finance?

“I’m terrible about reading books. I was the kid who would skim through the book in school, write a report and get an “A” somehow.

But, when I do read, I read things that are going to teach me something.

I read Rich Dad, Poor Dad like many people do early on in their financial journey. It got my mind in the right space, but it didn’t move my financial needle.

I studied finance in undergrad and grad, so I knew math and financial concepts. But, schools teach you how to use finance to make a company better, but the classes don’t teach you how to apply the concepts to your own finances.”

Why did you create Worth-Life Balance?

“I started Worth-Life Balance because 2020 was a year that highlighted many inequities in America. So while I came from little, I was fortunate enough to be doing well financially by many measures.

I wanted to take what I was building for my family and share it with others to make some dent in the wealth gaps that plague our society.”

What is one piece of advice you would share with someone seeking financial freedom?

“You are smart enough. Strong enough. Patient enough. And valuable enough to pursue financial freedom.

Every one of us has a supercomputer for a brain. It may have been programmed differently during the course of our lives, but the hard drive capacity is always there.

The worst thing we often do is create programs that we run in our heads that are self-destructive. “That looks like too many numbers.” Or, “That finance video is more than 30 seconds long.” Or without trying much, “It’s all just overwhelming.”

If anyone thinks they don’t have what it takes to build wealth, ask Siri or Google “Janitor who became a millionaire.”

Conclusion

Brandon says that building wealth includes the following –

- living below your means (not spending all that you make),

- investing a portion of it in appreciating assets,

- being diversified

- and doing it repeatedly over a period of time.

If financial freedom is your heart’s desire, you have to do like Brandon did. Educate yourself, avoid distractions and limit lifestyles that keep you financially dependent.

Fortunately, pursuing financial freedom today is not only trendy, it’s accessible

Brandon said it best – “The good news is, so many more people are leaning into financial literacy and I’m here for it.”

Brandon is the creator of Worth-Life Balance, a financial literacy community that seeks to close wealth gaps by empowering people to build financial security. He is a proud husband and father, and despite humble beginnings has helped his family become first-generation multimillionaires.