To paint the best picture, you need the best tools.

The thing is, not everyone benefits from the same tools.

Some of you prefer an online application that nearly eliminates any manual input. And, others prefer a hands-on tool that gives flexibility to customize all aspects of your budget.

The key is to find the tool that you will use consistently.

This means, if you do not normally use an app to carry out daily functions (banking, fitness, etc.), then you might not find value in a budgeting app.

On the contrary, if you plan your vacations, Christmas lists and everything else in excel, then an excel budget might offer you the most benefit.

To accommodate each preference, here are three budget tools and templates that will help you leverage your financial goals.

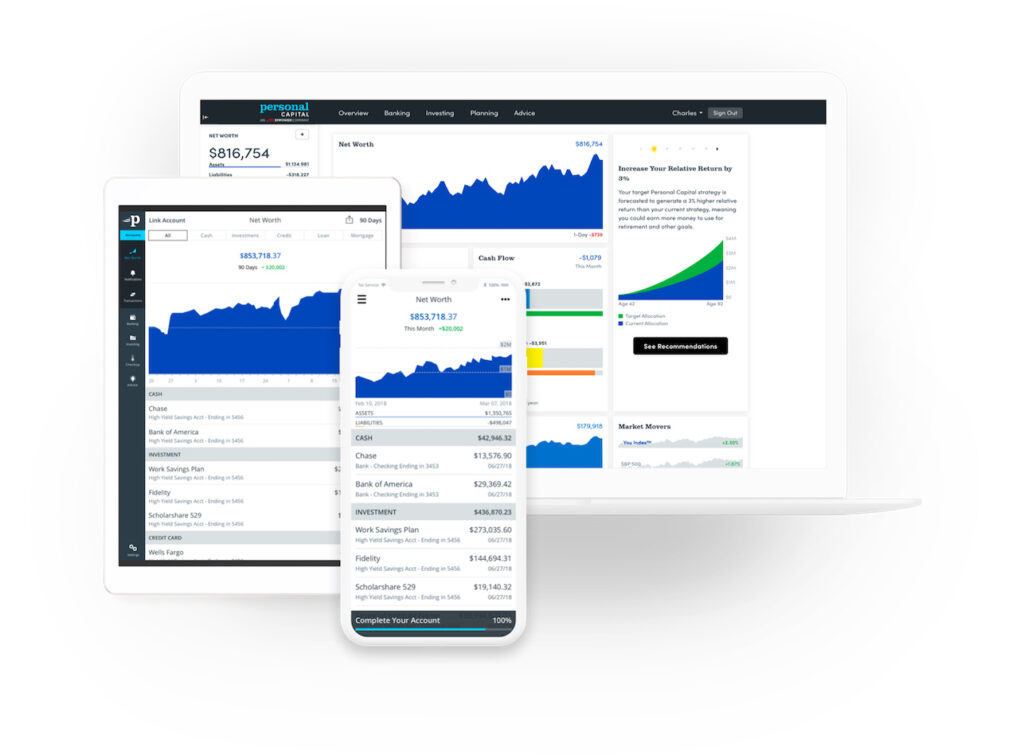

Empower

Empower is a financial technology (fintech) resource that provides cash management, wealth management and financial tools.

Empower is a financial technology (fintech) resource that provides cash management, wealth management and financial tools.

Its features include an app, a website and interactive resources. All of these options make it a great fit for somebody who is looking for a comprehensive financial picture.

On Personal Capital, you can –

- budget,

- track your bills,

- set savings goals,

- track your net worth and investing goals,

- get qualified advice from licensed financial professionals,

- …and more.

Empower is the most well-rounded app to capture all of your personal finance needs because it consolidates all of your accounts in one place. This gives you an accurate picture of your financial situation so that you can make informed decisions about your money.

One of the best features Personal Capital offers is the ability to see how your portfolio is doing compared to similar portfolios. This way, you can see if you need to make any changes to ensure that your investments are on track.

Personal Capital also offers exceptional customer service; they will even give you a call if they see something that looks off in your account!

The app is free to use, and there are no hidden fees or commissions. The app is available on iPhone and Android, and you can sign up for an account at www.personalcapital.com.

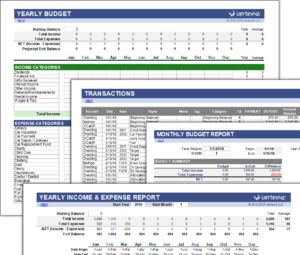

Vertex 42 Money Management Template

Excel wizards, this one’s for you.

Excel wizards, this one’s for you.

Beautifully, this Money Management Template maintains a simple design while tracking transactions, yearly reports, goals, accounts and more.

Although the flow through of data limits ultimate customization, the workbook allows you to add plenty of line items and personal touches to form your ideal budget.

Also, Excel fans who would not define themselves as wizards might find this workbook to be user friendly due to its clear instructions and professional interface.

And, most importantly, downloading this template will not break your budget because it is free!

The Organized Money Budget Planner

If you are the person who enjoys DIY, keeps a journal, decorates scrapbooks or schedules appointments with a physical calendar – the Organized Money Budget Planner is for you.

This is the planner of all planners.

This workbook includes a debt-payoff tracker, savings plan, goal setting, expense tracking…and so much more.

The name says it all. This planner will absolutely keep your money organized.

Not only that, the Organized Money Etsy Shop has stickers, printables and tracking decor to unleash your craft skills onto your financial plan.

Conclusion

These budget tools allow you to attach a time and dollar amount to each of your financial goals.

When used consistently, these tools can push you towards financial success.

Keep in mind, a budget will only be useful if you regularly analyze and update it. So, make sure you choose a budget tool that meets your preferences.

Happy budgeting!

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, investment or accounting advice. This information is not endorsed by a financial institution. You should consult your own tax, legal and accounting advisers before engaging in any transaction.