Are you thinking of investing, but aren’t sure where to start?

Here are five things to consider before you invest your money. By understanding these basics, you can make more informed investment decisions and protect your hard-earned dollars.

Asset Allocation

Before you invest, consider what you want to invest in.

Are you adventurous and want to dabble in blockchain and cryptocurrency?

Do you want keep it simple and passively invest in index funds and exchange-traded funds (ETFs)?

Are you interested in building a real estate portfolio with multi-family investment properties?

Whichever assets you choose, know that what you invest in is called asset allocation.

Asset Allocation is the heart of your investing strategy. It’s how you allocate your resources among various investments ( stocks , bonds etc.) to meet financial goals.

There are two main types:

- Active management – involves managing funds manually based on specific trading strategies or market timing;

- Passive investment – a strategy where you place all your money in one particular asset class like U.S. Index Funds.

Alright, now that you know what asset allocation is…let’s keep it real.

If you are new to investing, then knowing what investments will provide for the long-term is beyond your capabilities, right?

Luckily there’s a solution!

The best way to gain knowledge is to –

- Work closely with an experienced professional who can help guide not only where money should go but also when – or if – panic buttons need pushing;

- Use online research tools such as Yahoo! Finance and Morningstar that offer great information about stocks; or

- Work with a Robo-Advisor like Betterment or SoFi that automate your investment process for a low management fee.

And, keep in mind, a lot can change over the course of years, which means your asset allocation might need to be reassessed.

Your financial professional or online research tool will help you get started on an investment strategy that is appropriate for where YOU are today!

Example: You passively invest in Growth Index Funds in your 20s (i.e. VIGAX) to achieve financial independence in your 30s.

Risk Tolerance

Before you invest, you’ll also want to assess your risk tolerance.

Before you invest, you’ll also want to assess your risk tolerance.

Risk tolerance is a measure of how much risk you are willing to take.

How do you assess your risk tolerance?

Well, ask yourself – how much you are willing to lose for a (potential) strong return on investment?

If you are fearful of losing too much money and prefer slow yet steady investment returns, your risk tolerance is low.

If your fear of losing money is minimal compared to your confidence in investment returns, your risk tolerance is high.

Although, technically, every investment is associated with some type of risk, your risk tolerance provides a standard for how volatile assets fit into your portfolio, giving peace-of mind and security when making decisions about your finances!

Example: Elon Musk’s willingness to purchase Twitter for 4x its value confirms his risk tolerance is much higher than most middle class investors.

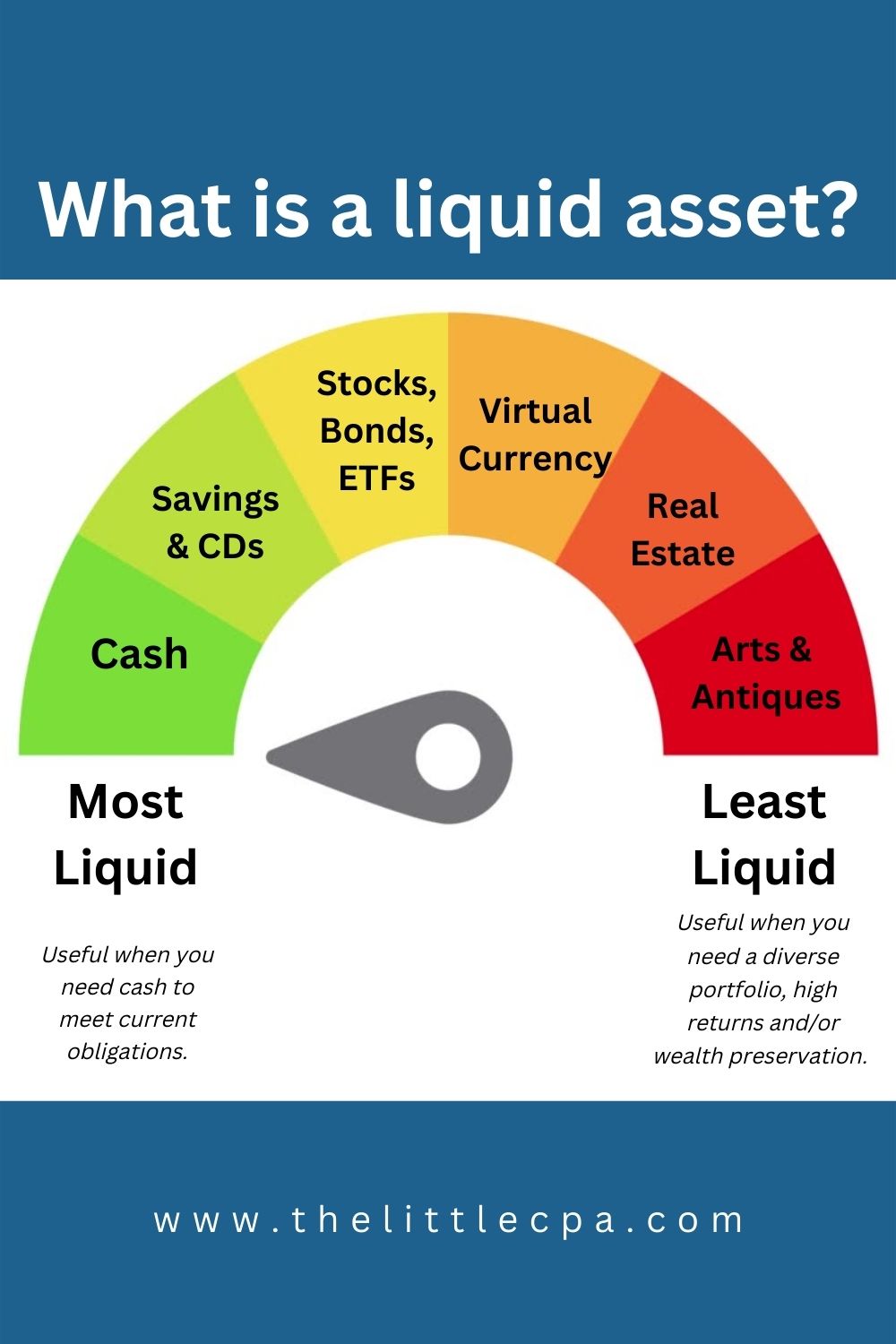

Liquidity Needs

Another key factor when determining how much to invest and what type of investment would be best for you is – liquidity.

Liquidity is what you need to access cash.

If your liquidity need isn’t immediate, then you might be more likely to invest in real estate since some properties can take months or years before they generate cash flow.

On the other hand, if your need for liquidity is more urgent, you might prioritize investments in U.S. Treasuries, Bonds, or High-Yield Savings.

Example: Due to high inflation, a retiree needs immediate access to cash. It might make sense not to invest their retirement savings in stocks or bonds which can require months before receiving their money back from an institution.

Ethical Values

In 2022, it’s common to align ethical, moral or religious values with your investments.

You can utilize tools like Inspire Insight’s Free Faith-Based Investment Screening Tool, Adasina’s social justice index and other tools to make sure the companies you invest in align with your values.

With these tools, you can learn if these companies give back funds through charity efforts, invest in ethical causes or do other forms of social responsibility.

Example: A person who objects strongly against child labor might intentionally avoid investing in companies that utilize sweatshops as their business model because they feel it goes against his/her ethical belief.

Tax Strategy

Choosing the right investment is important, but choosing the right investment vehicle is vital when considering how taxes will affect future earnings opportunities.

The right investment vehicle can help you save taxes and keep more money in your pocket.

Your tax strategy will determine whether you hold your investments in a taxable brokerage account, Roth IRA, UTMA or other investment vehicle.

Example: An employee who expects to be in higher income brackets at retirement might put most stocks into a Roth IRA so that they won’t pay taxes during their golden years!

Conclusion

While there are a lot of things to consider before you start investing, keep in mind that time is money.

So, be intentional in your consideration of these investing basics in order to get that jumpstart into your investment journey.

The sooner you invest, the sooner you can achieve your financial goals.

If needed, consult with a Certified Financial Planner to walk through and implement your investment strategy.

By taking the time to think about these things before you start investing, you’ll put yourself in a better position to succeed.