Key points:

Before you invest, keep in mind that asset allocation defines your strategy by balancing different investment types to meet your specific goals.

Understanding your risk tolerance ensures you choose investments that align with your comfort level regarding potential losses.

Evaluating liquidity, ethics, and taxes helps you select the right vehicles and companies for your long-term financial health.

Are you thinking of investing, but aren’t sure where to start?

Here are five things to consider before you invest your money. By understanding these basics, you can make more informed investment decisions and protect your hard-earned dollars.

Understand Your Asset Allocation

Before you invest, you must decide exactly where to put your money.

Whether you want to dabble in cryptocurrency, passively invest in index funds or build a real estate portfolio, your choices define your “asset allocation.”

Asset allocation is the heart of your financial plan because it is how you distribute your resources among various categories like stocks and bonds.

Think of asset allocation as the strategy of “not putting all your eggs in one basket.”

Instead of betting your entire savings on a single company or one type of investment, you spread your money across different categories—like stocks (which offer high growth but more risk), bonds (which are steadier but grow slower), and cash. Because these different “baskets” rarely move in the same direction at the same time, when one goes down, another might stay stable or even go up.

By choosing a specific mix based on your age and goals, you create a safety net that protects you from a total loss while still allowing your wealth to grow over time.

Determine Risk Tolerance

Your comfort level with market swings significantly impacts your success.

Consequently, you must assess your risk tolerance before you invest a single cent.

Ask yourself: how much money are you willing to lose in exchange for a high potential return?

If you prefer slow, steady gains and fear significant losses, you have a low risk tolerance. Conversely, if you feel confident chasing high returns despite volatility, your risk tolerance is high. Understanding this boundary provides peace of mind and keeps you from panicking during market dips.

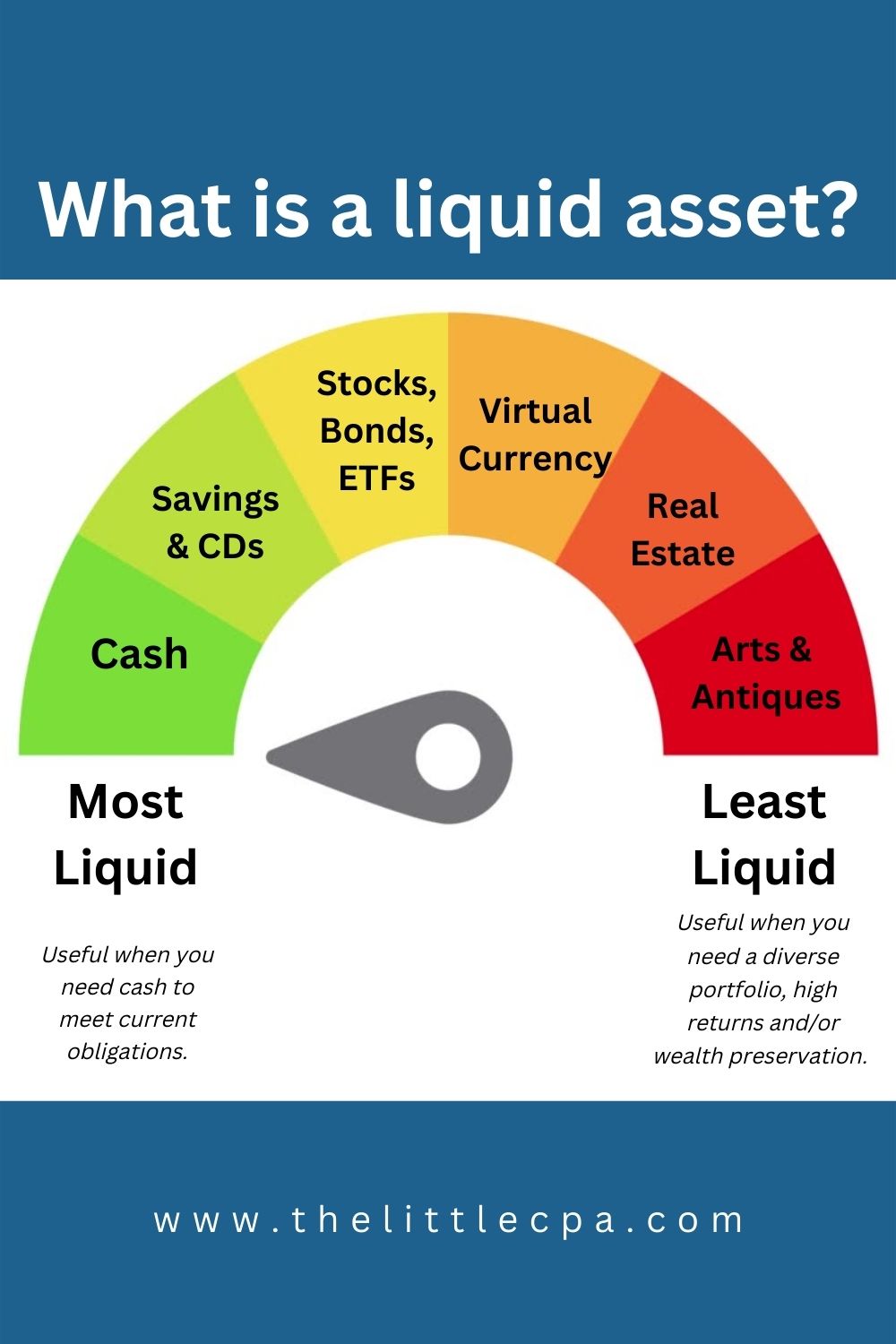

Evaluate Your Liquidity Needs

Liquidity refers to how quickly you can access your cash. This factor dictates which assets fit your timeline.

If you don’t need immediate cash, you might choose a less liquid investment like real estate which can appreciate in value over time and potentially produce significant cash at a later date.

However, if you anticipate needing funds soon, you might prioritize investing more of your funds in “liquid” assets like High-Yield Savings accounts or U.S. Treasuries.

Always match your investment timeline to your life goals before you invest.

Align with Your Ethical Values

Modern investors often align their portfolios with their moral or religious beliefs. You can use tools like Inspire Insight’s Free Faith-Based Investment Screening Tool, Adasina’s social justice index and other tools to vet companies.

These resources reveal if a corporation supports ethical causes or engages in practices that contradict your values.

Investing with a conscience allows you to grow your wealth without compromising your integrity.

Example: A person strongly against child labor might intentionally avoid investing in companies that utilize sweatshops as their business model because they feel it goes against his/her ethical belief.

Optimize Your Tax Strategy

Selecting a great stock is only half the battle; you also want to choose the most ideal type of investment account. Examples of investments accounts include:

- Taxable Brokerage Accounts

- Health Savings Accounts

- UTMA / UGMA Accounts

- Roth IRAs

- Traditional IRAs

Example: An employee who expects to be in higher income brackets at retirement might put most stocks into a Roth IRA so that they won’t pay taxes during their golden years!

The right vehicle can keep more money in your pocket and protects your future earnings from unnecessary taxation.

Conclusion

While many variables exist in the financial world, time remains your greatest asset.

Therefore, be intentional as you weigh these basics to jumpstart your journey. It is always wise to consult with a Certified Financial Planner to help you implement your strategy.

By reviewing these five pillars before you invest, you position yourself for lasting financial success.

Disclaimer: This material is for informational purposes only and is not intended as tax, legal, or accounting advice. Consult your own advisors before making significant financial commitments.

No Professional Advice (Investment, Tax, or Legal) The content provided by The Little CPA is for informational and educational purposes only. The Little CPA does not offer investment, tax, legal, or any other type of professional financial advice. None of the information on this website constitutes a recommendation, solicitation, or offer to buy or sell any securities or financial instruments. While we discuss financial concepts and strategies, these are general in nature and do not take into account your specific objectives, financial situation, or needs.

No Professional-Client Relationship Your use of this website or engagement with this content does not create a CPA-client, attorney-client, or financial advisor-client relationship. The Little CPA is not your fiduciary. A professional relationship is only established through a formal, signed engagement letter specifically tailored to your individual circumstances. You should consult with a qualified professional who is familiar with your unique financial situation before making any significant financial or legal decisions.

General Information Only This material is prepared by The Little CPA as a resource for self-research and general education. While we strive for accuracy, the rapidly changing nature of tax laws and financial regulations—particularly the 2026 tax law updates—means this information may not be complete or applicable to your specific situation. We disclaim all liability for any actions you take based on the information found here.

Past Performance & Risks Any examples of tax savings or investment returns are for illustrative purposes only. Past performance does not guarantee future results. All financial decisions carry inherent risk, and the user assumes all responsibility for any losses or outcomes resulting from their personal financial choices.

Third-Party Risk References to specific software, banks, or storage providers are not endorsements. We are not liable for any issues, data breaches, or financial losses that may arise from your engagement with third-party vendors.