Key points:

- A Roth IRA investment strategy allows your money to grow and be withdrawn entirely tax-free during retirement.

- You must leave funds in the account for five years and reach age 59.5 to avoid penalties.

- Prioritize employer 401(k) matches before contributing to a Roth IRA to maximize your total savings.

Updated February 1, 2026

Q&A with Bryan Hasling, CFP®

A Roth IRA serves as a specialized individual retirement account that allows your money to grow tax-exempt.

While you fund the account with “after-tax” dollars—meaning you don’t get a tax deduction the year you contribute—the trade-off can be significant: every dollar of investment growth can be withdrawn tax-free in your later years.

Because of these unique benefits, the IRS sets specific rules regarding who can contribute and how much. Understanding these mechanics is the first step in deciding if a Roth IRA investment strategy aligns with your broader financial goals.

The Little CPA reached out to Certified Financial Planner, Bryan Hasling, to explore how these accounts function in a real-world plan.

Q: What are the benefits and rules of a Roth IRA?

Bryan: A Roth IRA is one of the most powerful investment accounts an investor can own.

If done properly, all growth from your investments can be withdrawn completely tax-free in retirement.

There is no tax deduction upfront for saving into these accounts. The main benefit is the future tax-free growth.

To get the most benefit from the growth in your Roth IRA, you must meet 2 qualifications:

- your Roth IRA must be open for 5 years, and

- you must withdraw after age 59.5.

If you don’t reach those two, the growth portion of your withdrawal is subject to tax and 10% penalty.

There is an important exception to this tax and penalty: you are allowed to withdraw your contributions at any time, even if you withdraw before retirement years.

Since a Roth IRA’s tax-free benefit is so powerful, the IRS limits who can save into them and how much.

There are income limitations, and the annual amount you may be able to save is $7,000 for 2024 (or $8,000 if you’re over age 50).

The Little CPA Note: For 2026, you can contribute up to $7,500 if you are under 50. If you are 50 or older, you can add an extra “catch-up” contribution of $1,100, bringing your total to $8,600.

Q: When should someone start investing with a Roth IRA?

Bryan: At the highest level, you should save into Roth IRA if you’re ready to save more for your retirement goals.

Remember, the key benefit is that you can earn tax-free growth if you meet the requirements.

If you need cash in the next few years (or well-before age 59.5), there are likely better accounts to help you with those goals, instead of a Roth IRA.

As mentioned, you are allowed to withdraw your contributions portion (not the growth) before retirement years, without penalty. For that reason, many people use Roth IRAs for both short-term and long-term goals. The contributions can serve as an added emergency fund.

In my experience, however, I generally suggest that you use a Roth IRA for pure, long-term savings. I find that it is much simpler to coordinate your overall finances when each account has a specific role in your plan.

But personal finances are… personal.

Each person should choose what feels best to them.

Q: I have a 401(k) through my employer, should I save into a Roth IRA instead?

Bryan: If you are ready to begin saving for the long-term, usually the best place start is in your company’s 401(k) plan (if available). These accounts share the same tax-incentives that IRAs do.

I like 401(k)’s because the set-up is easier for new investors.

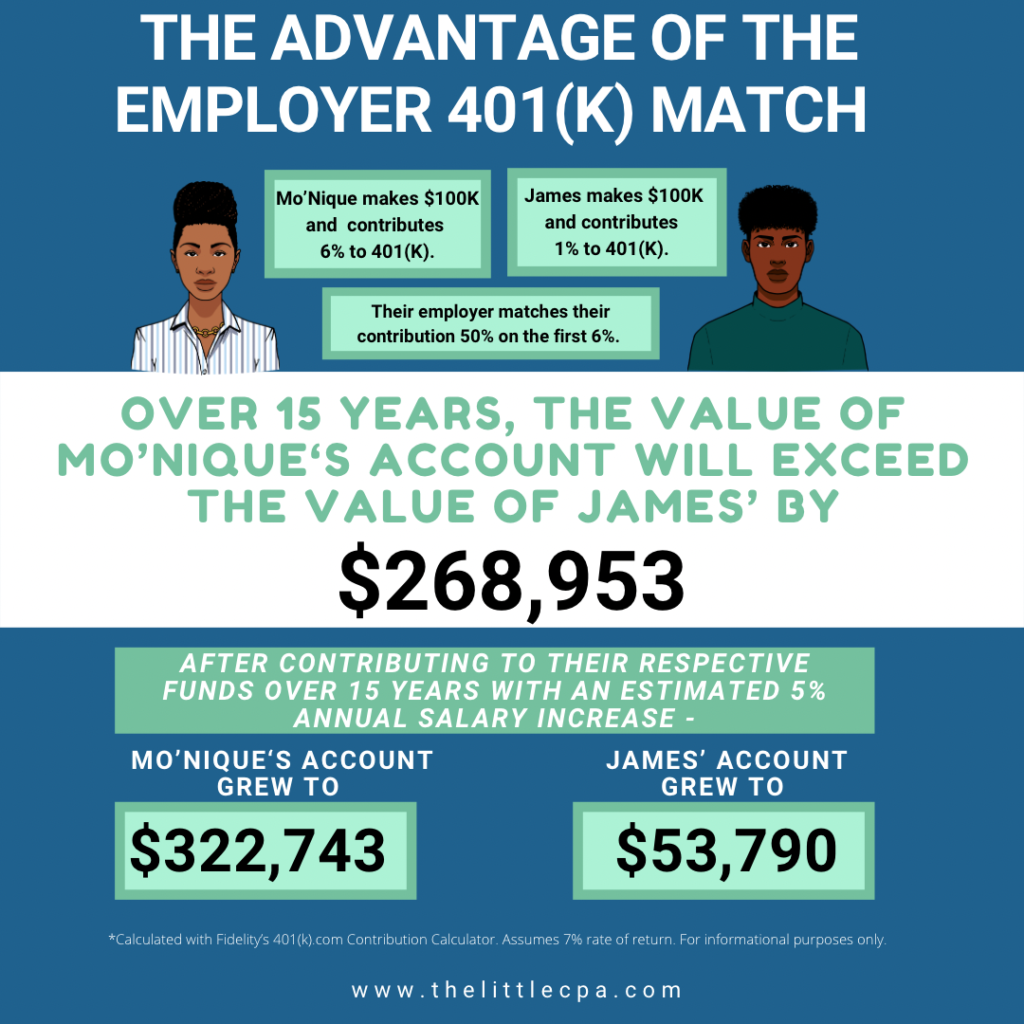

Even better, your company might incentivize you by offering an “employer match.”

This means that if you save into your account, they’ll follow your lead and deposit money in your account. This is as close to “free money” that you can get. If you have an employer match, saving here is your top priority.

Once you’ve taken advantage of the employer match, you can then decide where else you want to save.

This is where it pays to know how all your accounts work.

Q: The Roth feature within certain 401(k) plans:

Bryan: In most 401(k)’s, the default savings option is Pre-Tax (“traditional”) deductions. Meaning if you save, you get a tax deduction today, but you will pay taxes on future withdrawals.

Many 401(k) plans also offer a “Roth feature” (i.e., a Roth 401(k)), which provides the same tax-free advantages that a Roth IRA offers.

The Little CPA Note: Starting in 2026: If you are 50 years and older and earned more than $150,000 last year and want to make “catch-up” contributions to your 401(k), the law now requires those specific contributions to be Roth-based.

In that case, you won’t need to open a separate Roth IRA until you’ve taken full advantage of your current 401(k) limits. The mechanics are much easier and the annual limit into a 401(k) is higher.

In that case, you won’t need to open a separate Roth IRA until you’ve taken full advantage of your current 401(k) limits. The mechanics are much easier and the annual limit into a 401(k) is higher.

Once that is taken advantage of, you can start to look at a Roth IRA to supplement the savings.

The Little CPA Note: Keep in mind that, unlike the Roth IRA, a Roth 401(k) has a required minimum distribution at age 72. So, if you live beyond age 72, you will not be able to pass your entire retirement savings to a beneficiary via your Roth 401(k).

Q: Pre-tax versus Roth: How to make the best tax decision:

Bryan: The right answer is different for each person’s situation. But here is some general framework to help you decide:

For those who are in their highest-earning years of their lifetime. They will typically want to use all pre-tax savings options available to them. This is typically pre-tax 401(k) and/or HSA (health savings account) contributions.

For those who are just getting started in their careers or expect to have much higher earnings in the future, they will want to use all Roth options available.

For everyone, I suggest not getting too hung up on the Pre-tax versus Roth tax decision. It’s more important to put money into long-term accounts and let the money work. You can sort out the finer details over time.

Q: What type of assets can be held in a Roth IRA?

Bryan: You can invest in any publicly traded stocks or bonds in your Roth IRA. Publicly traded just means that they’re available for you to buy or sell (i.e., trade) whenever you want.

You can also purchase stocks and bonds in the form of funds, like Mutual Funds or ETFs (exchange-traded funds). Investing in funds is a simple way to diversify your holdings and not need to worry about placing bets on specific companies.

The Little CPA Note: You can also purchase real estate and other non-traditional assets within a self-directed Roth IRA. Although the “tax-free” earnings from these sources of income seem appealing, keep in mind these types of Roth IRA holdings are subject to strict rules and tax compliance. Speak with a tax, financial and legal advisor before making this investment within your Roth IRA.

Conclusion

Roth IRA accounts offer a lot of benefits, and they’re worth looking into if you want to save for retirement.

But, Roth IRAs are not for everybody. In fact, if your income is over the IRS threshold, you might not be able to contribute to a Roth IRA unless you use the “backdoor.”

The Little CPA Note: High earners should watch the new income phase-outs. For 2026, the ability to contribute directly to a Roth IRA begins to phase out at $153,000 for single filers and $242,000 for married couples filing jointly. These taxpayers should discuss the pros and cons of using the backdoor strategy with a qualified tax and wealth management professional.

About the Expert:

Bryan Hasling is a Certified Financial Planner and an Enrolled Agent. He helps ambitious professionals and successful families reach financial independence.

His specialties include retirement planning with ongoing tax guidance and investment management. Most of his clients are in the SF Bay Area (where he works) and Texas (where he’s from).

Disclaimer: This material is for informational purposes only and is not intended as tax, legal, or accounting advice. Consult your own advisors before making significant financial commitments.

No Professional Advice (Investment, Tax, or Legal) The content provided by The Little CPA is for informational and educational purposes only. The Little CPA does not offer investment, tax, legal, or any other type of professional financial advice. None of the information on this website constitutes a recommendation, solicitation, or offer to buy or sell any securities or financial instruments. While we discuss financial concepts and strategies, these are general in nature and do not take into account your specific objectives, financial situation, or needs.

No Professional-Client Relationship Your use of this website or engagement with this content does not create a CPA-client, attorney-client, or financial advisor-client relationship. The Little CPA is not your fiduciary. A professional relationship is only established through a formal, signed engagement letter specifically tailored to your individual circumstances. You should consult with a qualified professional who is familiar with your unique financial situation before making any significant financial or legal decisions.

General Information Only This material is prepared by The Little CPA as a resource for self-research and general education. While we strive for accuracy, the rapidly changing nature of tax laws and financial regulations means this information may not be complete or applicable to your specific situation. We disclaim all liability for any actions you take based on the information found here.

Past Performance & Risks Any examples of tax savings or investment returns are for illustrative purposes only. Past performance does not guarantee future results. All financial decisions carry inherent risk, and the user assumes all responsibility for any losses or outcomes resulting from their personal financial choices.

Third-Party Risk References to specific software, banks, or storage providers are not endorsements. We are not liable for any issues, data breaches, or financial losses that may arise from your engagement with third-party vendors.