Key takeaways:

- A HELOC is a flexible borrowing option that grants you access to a line of credit based on the equity you’ve built in your home.

- HELOCs are often used for ongoing expenses, unexpected costs and multiple-stage home improvements.

- Thomas Kopelman, Co-Founder of AllStreet Wealth, emphasizes that the best time to use a HELOC is in a low interest rate environment, when you have plenty of equity in the home, among other considerations.

One of the main benefits of owning a home is, over time, gaining access to the “treasure chest” of built-up value known as equity.

Home equity is the difference between the value of your home and what you still owe on your mortgage.

When you have equity in your home, there are many ways you can turn your equity into cash – you can sell your home, refinance your mortgage or even borrow against your equity with a Home Equity Line of Credit (HELOC).

In this blog, we delve into the world of HELOCs, exploring their risks and benefits. We also shed light on why certain financial experts advocate for their incorporation into a well-rounded financial strategy.

What is a HELOC?

A HELOC is a flexible borrowing option that grants you access to a line of credit.

The amount of credit you can use is based on the equity you’ve built in your home.

Think of it like this:

- Your home is worth $600,000.

- You owe $450,000 on your mortgage.

- Your equity is $150,000.

- You can typically borrow until your loan-to-value (LTV) ratio reaches around 80%. In this example, the maximum debt for an 80% LTV ratio is $480,000 (80% x $600,000 value). That means, the most you get get out of a HELOC is $30,000 ($480,000 maximum debt – $450,000 mortgage).

How a HELOC Works

A HELOC is a type of revolving credit, similar to a credit card. You can draw on it as needed and pay it back over time.

Draw Period

During the draw period, which varies by lender but typically lasts 5 to 10 years, borrowers can access funds up to their approved credit limit. Monthly payments are usually interest-only during this phase, giving borrowers greater flexibility in managing their cash flow.

Certain lenders may allow you to make principal payments during the draw period. You will want to read the HELOC agreement to confirm and review for any prepayment fees.

One of a HELOC’s best features is that interest payments are only required if you draw funds from the line of credit. So, if you open a HELOC and never use the funds, you will not incur interest. That’s why some people open HELOCs with no specific project in mind. The funds are accessible “just-in-case.” Pretty cool, right?

Also, keep in mind that some lenders will allow you to convert a HELOC interest rate from variable to fixed during the draw period. Since the requirements, fees and options vary per lender, make sure to discuss with your lender before you get your loan.

Repayment Period

Once the draw period concludes, the repayment period begins. During this stage, borrowers can no longer withdraw funds, and they must start repaying both principal and interest.

The repayment period typically spans 10 to 20 years. The interest rates may be variable, leading to fluctuations in monthly payments based on prevailing market conditions. Even so, HELOC interest rates are often lower than those of credit cards and certain student loans.

The draw and repayment period make HELOCs a flexible tool for various financial goals, such as:

- Home improvement projects: Give your kitchen a makeover, add a deck, or finally finish that basement.

- Debt consolidation: Roll high-interest debt into your HELOC and score a lower rate, potentially saving you thousands.

- Education expenses: Help your kids reach their academic dreams without breaking the bank.

- Unexpected costs: Life throws curveballs, and a HELOC can be a safety net for medical bills, car repairs, or other emergencies.

Word of caution:

Certain HELOCs come with a unique feature known as a balloon payment, which becomes due at the conclusion of the draw period.

This lump sum payment has the potential to be substantial, reaching tens of thousands of dollars and often surpassing twice the amount of your usual monthly payments.

Before committing to a HELOC, it’s imperative to confirm whether a balloon payment is part of the arrangement, as these payments can pose challenges for borrowers. Refinancing may not always be a reliable escape route from the burden of a balloon payment, so it’s wise to thoroughly assess the terms before making any commitments.

How to Open a HELOC

Opening a HELOC is similar to getting a mortgage. You’ll need good credit, a steady income, home equity and proof of homeowners insurance.

Applying for a HELOC is like applying for any other loan:

- Shop around: Compare rates and terms from different lenders.

- Get your finances in order: A good credit score and proof of income are key.

- Appraisal time: Your home’s value will determine your borrowing limit.

- Closing costs: Be prepared for upfront fees associated with opening the HELOC.

Even though most banks and credit unions offer HELOCs, online lenders might have competitive rates too. Do your research and choose a lender that fits your needs and budget.

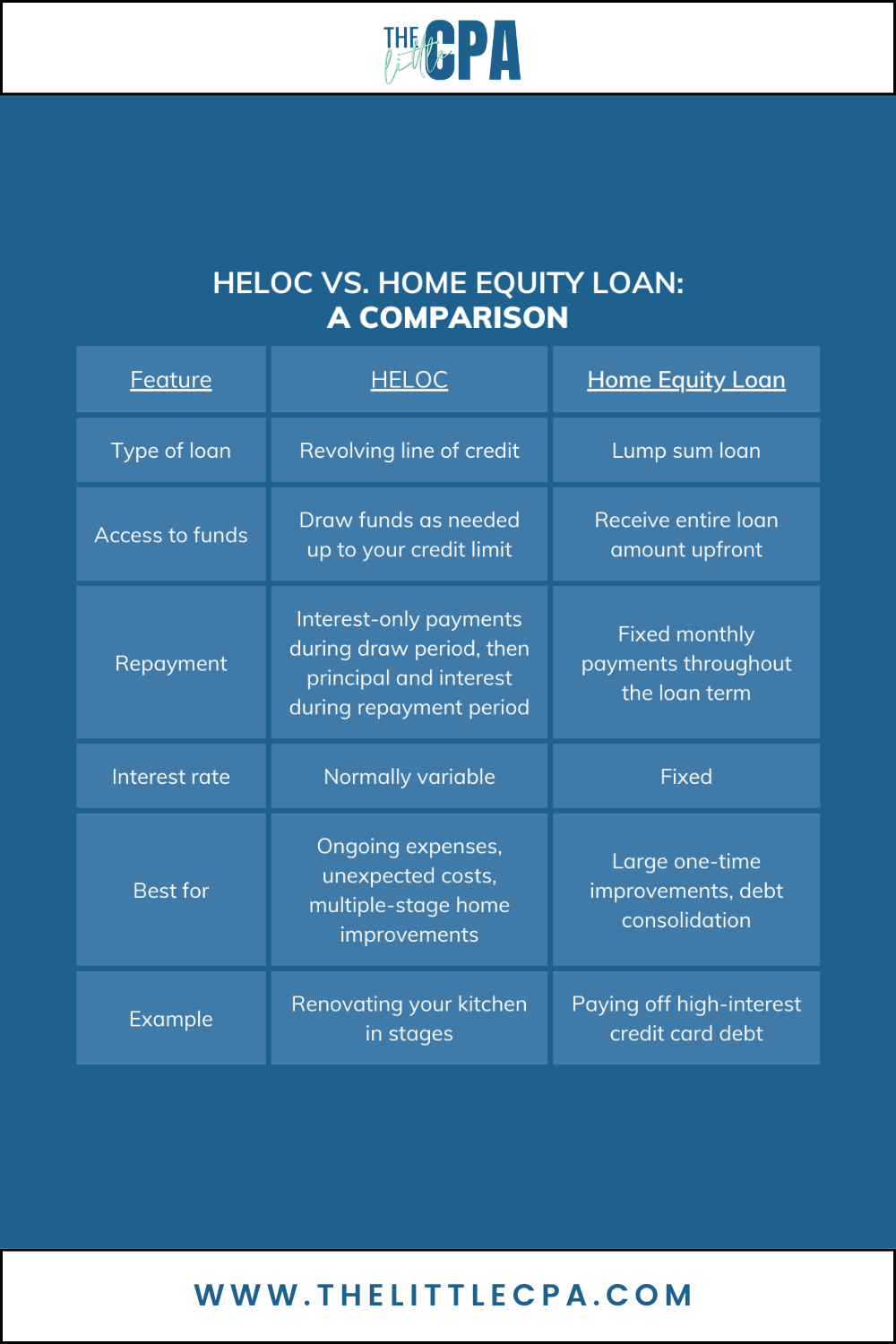

HELOC vs. Home Equity Loan

Take into account, when it comes to borrowing against home equity, a HELOC isn’t the best option for all homeowners.

Instead, some homeowners choose to open a Home Equity Loan.

While both HELOCs and Home Equity Loans provide homeowners with access to equity, they differ in their structures and functionalities.

A HELOC operates as a revolving line of credit, allowing borrowers to withdraw funds as needed within a set credit limit and repay the borrowed amount with variable interest rates. This flexibility is ideal for individuals with evolving financial needs.

On the other hand, a Home Equity Loan is a lump-sum loan disbursed upfront, with a fixed interest rate and predetermined monthly payments over the loan term. This structure suits those seeking a one-time infusion of funds for specific purposes.

Example:

Let’s say it’s time to repair the roof on your home and you don’t have the cash to cover the cost.

Since this is a specific, one-time renovation, you might consider taking out a Home Equity loan. You’ll receive a lump sum loan disbursement which can serve as the budget for your renovation.

On the other hand, If you needed funds to convert your garage into a studio apartment, you might consider a HELOC. While this is also a one-time renovation, this is a project that often occurs in stages. A specific budget for insulation, foundation work, and other items can be difficult to predict. You might also want revolving funds to plan for unexpected costs (plumbing, electrical, etc.).

The crucial distinction lies in the dynamic, ongoing access of a HELOC versus the fixed, immediate lump sum of a Home Equity Loan, providing homeowners with options tailored to their financial objectives and preferences.

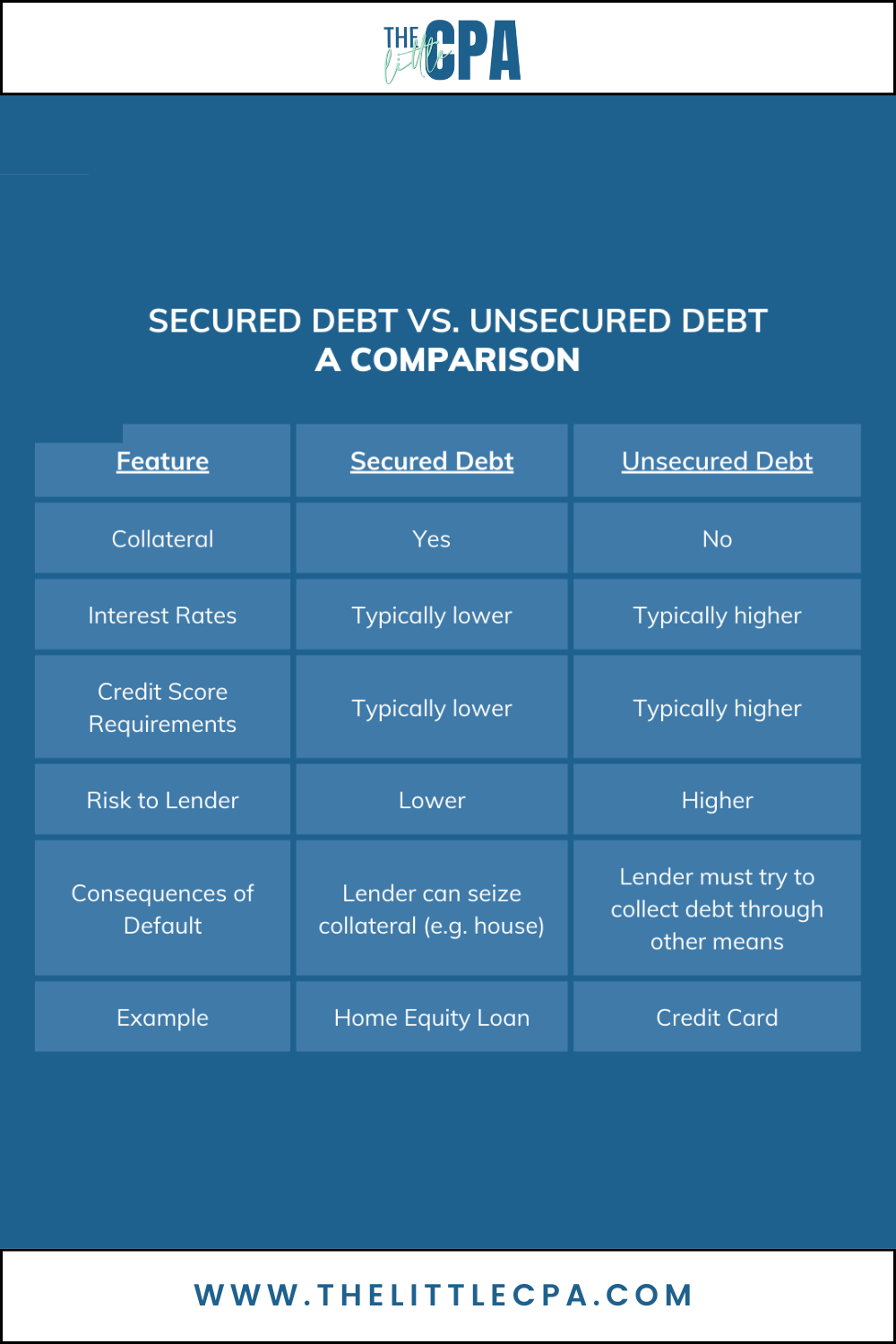

Secured vs. Unsecured Debt

Before opening a HELOC, it is important to understand that you are entering into a secured debt agreement.

- Secured debt is backed by collateral, which is an asset that the lender can seize if you default on the loan. For example, a mortgage is secured by your home, and a car loan is secured by your car. If you don’t make your payments on a secured loan, the lender can take the collateral to recoup their losses.

- Unsecured debt is not backed by collateral. This means that if you default on the loan, the lender has no recourse but to try to collect the debt from you through other means, such as taking you to court. Examples of unsecured debt include credit card debt, personal loans, and student loans.

Here’s a table that summarizes the key differences between secured and unsecured debt:

Although HELOCs often provide a lower interest rate, consolidating your credit card, student loan and any other personal loan payments into your HELOC means you shift your debt from unsecured to secured.

With your home as the collateral, you risk losing your home in the unfortunate event you cannot repay the consolidated loan.

How do HELOCs impact your tax liability?

This is The Little CPA, you know we can’t talk about HELOCs without an in-depth overview of the tax implications, right?

To learn about the mortgage interest deduction, alternative minimum tax and other ways HELOC interest can impact your tax liability, check out “Is Interest on Home Equity Loans and HELOCs tax-deductible?“

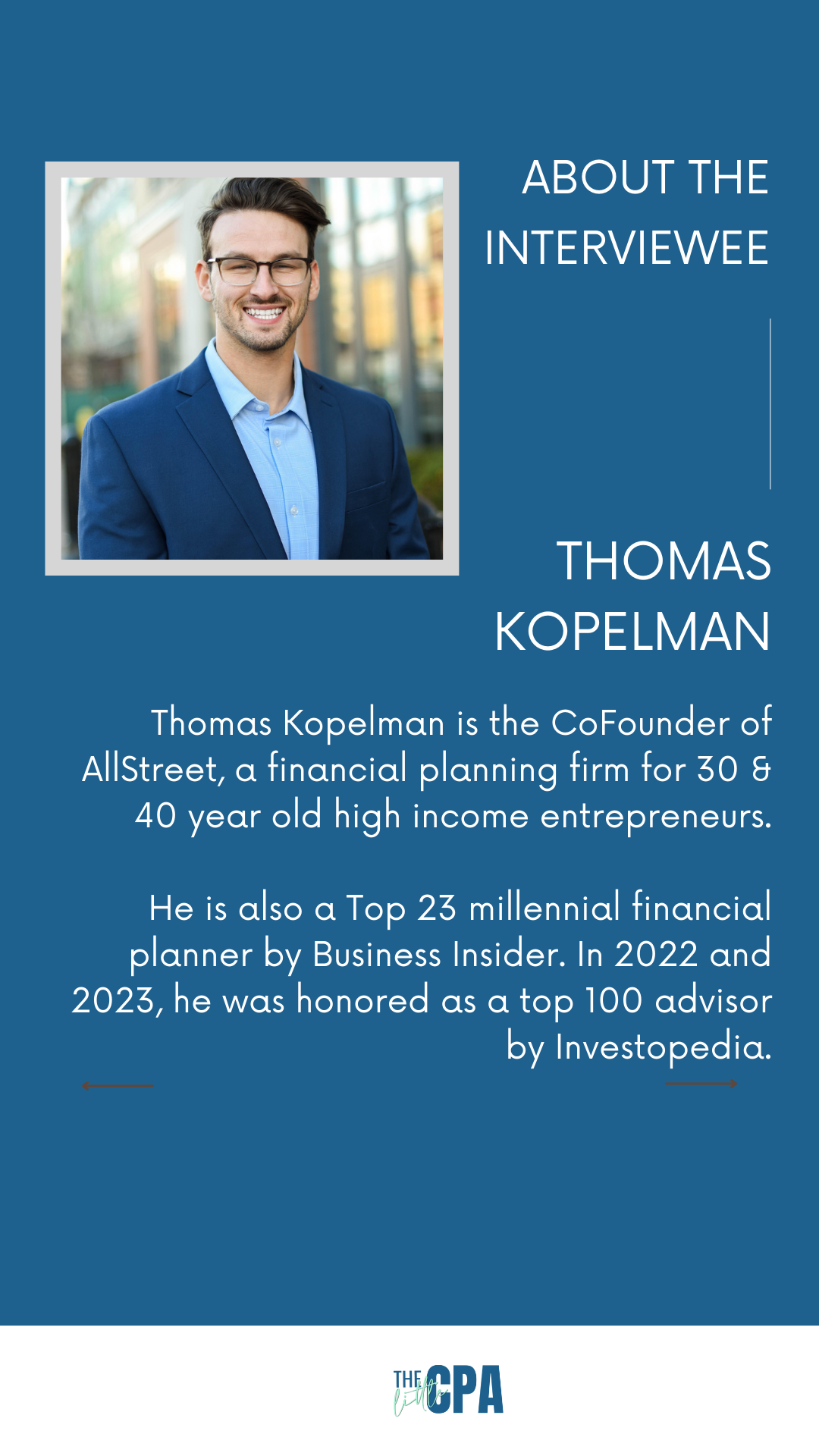

Interview with Thomas Kopelman

What do licensed financial advisors think about HELOCs?

For insight, we asked Thomas Kopelman, Co-Founder of AllStreet Wealth and an Investopedia Top 100 Advisor. Since most of his clients have strong enough financial positions to manage loan repayment, he often tells his homeowner clients to open a HELOC – even if they don’t need it.

“Oftentimes, a HELOC is best used as a backup emergency fund,” Thomas says. “The goal is not to use it to buy things you cannot afford, but to let it be there just in case you ever need it.”

“Oftentimes, a HELOC is best used as a backup emergency fund,” Thomas says. “The goal is not to use it to buy things you cannot afford, but to let it be there just in case you ever need it.”

Keep reading for to learn more from our Q&A with Thomas:

When would you advise against opening a HELOC to fund a home project, their business, etc.?

I would not recommend this for people who will have no income and no plan to pay this back. You typically would want to be in a strong position, have cash on the sidelines, not have high interest debt, etc.

I would say a HELOC for starting a business is less of a good idea than using cash. I would rather use cash and have HELOC as a backup in case you needed it.

When is the best time to open a HELOC?

You pay interest based on how much you use. If you open one for $100K, but do not use it, you are not paying interest on it.

It is best to use when interest accrues at a fixed rate, in a low interest rate environment, you have plenty of equity in the home, etc.

How can you manage the risks associated with taking out a HELOC?

You need to properly plan for repayment when the time comes.

Way too many took these out with large balances, did big home projects, and now the interest rate is high and they cannot pay them down. You need to make sure you have enough cash flow to actually pay the loan down.

Can you provide an example of when it makes sense to consolidate debt into a HELOC?

This can be a good strategy if someone has a bunch of high-interest debt like personal loans, credit cards, etc. Normally, consolidating all debt into a HELOC allows you to move your other debt into a way lower interest loan.

Why are HELOCs better than personal loans, credit cards, etc.?

They can be way better than credit cards or personal loans just because the rates are normally lower. Though, I would not recommend someone use this for daily spending at all. It typically makes sense for funding housing projects or something along those lines.

Final Considerations

As with any financial instrument, HELOCs come with their own set of advantages and disadvantages.

On the positive side, they offer homeowners a convenient source of funds for various purposes, from home improvements to debt consolidation.

However, the potential for fluctuating interest rates and the risk of overextending oneself are factors that necessitate careful consideration.

Despite the associated risks, some financial advisors recommend HELOCs as strategic financial tools when used judiciously, citing their potential to unlock liquidity and promote financial flexibility.

Here are a few final considerations:

- HELOCs are loans based on your home equity.

- They offer flexible access to funds for various needs.

- Shop around for the best rates and terms.

- Interest on HELOCs used for specific purposes may be tax-deductible.

- Use HELOCs responsibly and within your budget.

Finally, remember that HELOCs are not your only option for tapping into home equity. Home Equity Loans and Cash-Out Refinancing are other options with their own advantages and disadvantages.

Discuss your options with a qualified, licensed financial advisor who can help you make the best situation for your specific circumstance.

Disclaimer:

The information provided on this blog is for educational and informational purposes only. While every effort has been made to ensure the accuracy and reliability of the content, we do not make any representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information.

Please note that the financial advice and information presented on this blog are not personalized to your specific financial circumstances. It is essential to consult with a qualified professional, such as a financial advisor or accountant, before making any financial decisions or taking any actions based on the information provided here.

We strongly encourage our readers to conduct thorough research and verification independently. The information on this blog should not be considered as financial, investment, or legal advice. Any reliance you place on the information provided is strictly at your own risk.

It is important to understand that any financial product or service mentioned or promoted on this blog may have its own risks and potential drawbacks. We advise our readers to carefully read the terms, conditions, and fine print associated with any product or service before making any investment decisions.