Key takeaways from Is Interest on Home Equity Loans and HELOCs tax-deductible?

- Although interest paid on Home Equity Loans and HELOCs might be tax-deductible, loan proceeds and principal payments normally are not.

- To qualify for the deduction, loans taken out during tax years 2018 through 2025 must be used to buy, build or substantially improve your personal residence.

- Interest is only deductible up to certain debt thresholds.

Curious about whether the interest paid on your Home Equity Loan or Home Equity Line of Credit (HELOC) is deductible?

Curious about whether the interest paid on your Home Equity Loan or Home Equity Line of Credit (HELOC) is deductible?

In this blog, we discuss which part of the loan is deductible – and then deep dive into the interest deduction.

Note: The information below pertains to funds borrowed against the equity of your personal residence. Funds borrowed against equity on investment properties generally are subject to different reporting requirements and thresholds.

Loan proceeds

When you take out a Home Equity Loans or HELOC, the funds disbursed to you are called loan proceeds.

Similar to other types of debt, the loan proceeds are not considered taxable income.

Loan Fees

Closing costs, annual fees and other fees incurred to take out the loan are not deductible on your individual tax return.

Loan principal

When it’s time to pay back the loan, your payments will be paid towards the principal and interest of the loan.

Loan principal is the initial amount you borrow, like the price tag on a car. Interest is the fee for borrowing that money, like a rental fee for using the principal. You repay the loan by making regular payments that cover both the principal and the accumulated interest,

Repayment of loan principal is not tax-deductible.

Let’s say you made a $500 payment on a HELOC this month. If $350 of that payment was used to pay off the loan principal and $150 was paid towards interest, the $350 is not tax-deductible.

Keep in mind, there are certain exceptions in which loan principal might be deductible.

Check out “5 Tax Benefits for Your Home Improvements” to more about the tax impact of funds used for medical improvements and other capital improvements.

Loan interest

Interest paid on a HELOC loan might be tax-deductible. The deduction is similar to mortgage interest deduction.

The amount you can deduct depends on whether you itemize your deductions, how you use the funds and whether your home acquisition debt exceeds certain thresholds.

Itemized deduction

Interest paid towards home indebtedness is considered an itemized deduction. Itemized deductions include state and local taxes, property taxes, charitable contributions, home mortgage interest and more.

To take an itemized deduction, your combined itemized deductions must exceed the standard deduction.

In 2024, the standard deduction for single filers is $14,600 ($29,200 for married filing jointly).

That means, in order for qualifying interest paid towards a HELOC or Home Equity Loan to provide the best tax benefit, interest paid plus any other itemized deductions would need to exceed $14,600.

If qualifying interest payments plus any other itemized deductions are less than the standard deduction, it might make more sense to take the standard deduction to reduce your federal tax liability.

Use of funds

The amount you can deduct depends on when you opened the HELOC, the amount of your loan, and how the loan funds were used. According to the IRS –

“For tax years 2018 through 2025, if home equity loans or lines of credit secured by your main home or second home are used to buy, build, or substantially improve the residence, interest you pay on the borrowed funds is classified as home acquisition debt and may be deductible, subject to certain dollar limitations. However, interest on the same debt used to pay personal living expenses, such as credit card debts, is not deductible.

For tax years before 2018 and after 2025, for home equity loans or lines of credit secured by your main home or second home, interest you pay on the borrowed funds may be deductible, subject to certain dollar limitations, regardless of how you use the loan proceeds.

For example, if you use a home equity loan or a line of credit to pay personal living expenses, such as credit card debts, you may be able to deduct the interest paid.”

Home acquisition debt that exceed $750,000

Thanks to the 2017 Tax Cuts and Jobs Act, home acquisition debt incurred after December 15, 2017 and used for a qualifying purpose is only fully deductible on debt up to $750,000.

Here’s an example –

Let’s say you purchased a home in 2020 for $800,000 and incurred $600,000 in debt. Then, in 2024, you took out a $200,000 HELOC to add an upstairs unit.

As a result, your 2024 home acquisition debt balance was $800,000 ($600,000 debt plus $300,000 HELOC), which exceeds the deductible debt limit. That means, you can only deduct interest you paid on up to $750,000 of the debt.

Interest paid on the remaining $50,000 is not deductible.

Sound complicated? That’s where your tax professionals come in. They will have the software, formulas and spreadsheets to determine the deductible portion to report on your tax return.

To add even more complexity, home acquisition debt incurred before December 15, 2017 is fully deductible on debt up to $1,000,000.

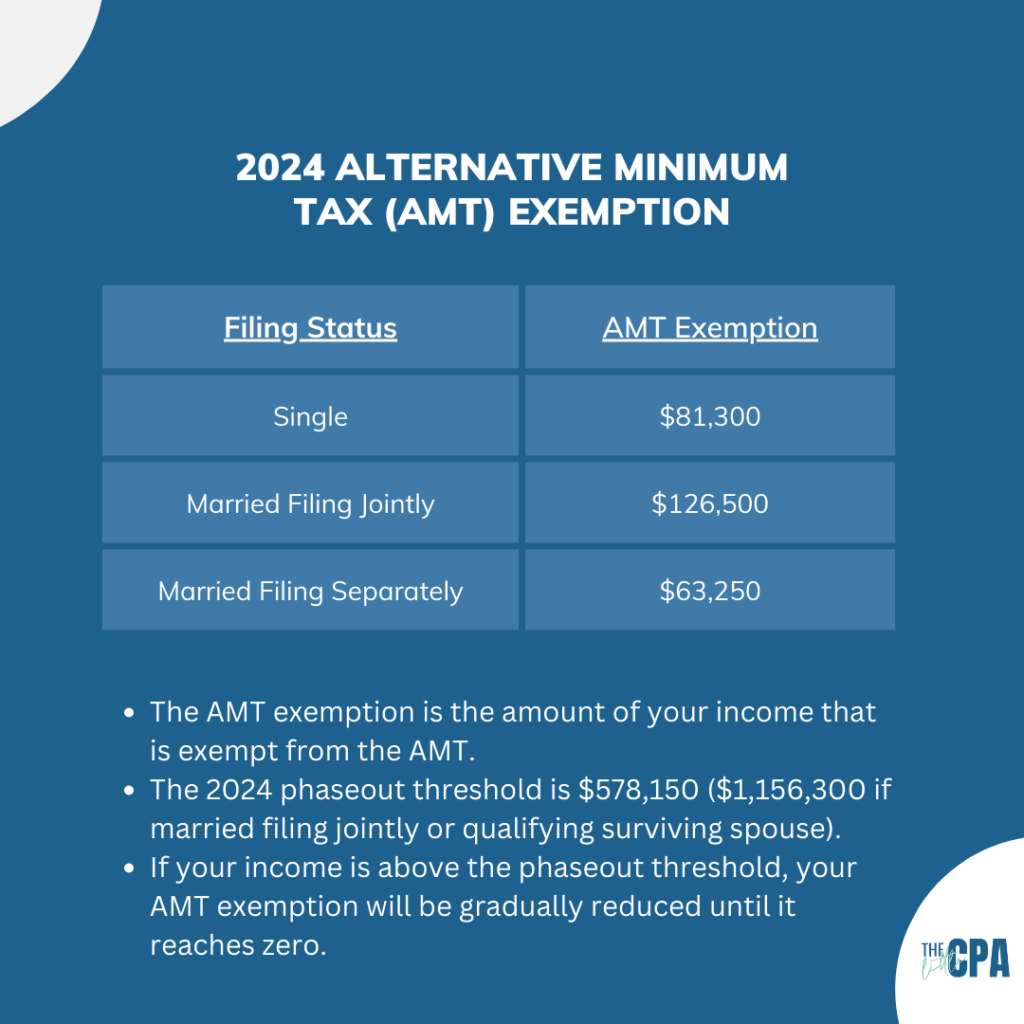

Alternative Minimum Tax (AMT)

Before you get too excited about the mortgage interest deduction, you need to know about Alternative Minimum Tax (AMT).

If your 2024 income exceeds the amounts listed below, listen up.

The AMT is a parallel tax system in the United States designed to ensure that high-income individuals and corporations pay a minimum amount of tax, regardless of deductions.

Essentially, it prevents taxpayers from exploiting loopholes to reduce their tax liability significantly.

Here’s a simple example to illustrate how it works:

Imagine you’ve calculated your regular income tax and then recalculated it under the AMT rules. If the AMT amount exceeds your regular tax liability, you must pay the higher AMT.

Now, let’s dive into the nitty-gritty of what gets added back when computing the AMT. Common items include –

- state and local taxes,

- personal exemptions,

- depreciation deductions, and yes,

- mortgage interest.

The goal is to provide a more comprehensive view of an individual’s or corporation’s income, ensuring that certain favorable tax breaks are taken into account.

Keep in mind, If you’re not liable for AMT this year, but you paid AMT in one or more previous years, you may be eligible to take a special minimum tax credit against your regular tax this year. If eligible, you should complete and attach Form 8801, Credit for Prior Year Minimum Tax – Individuals, Estates, and Trusts to claim the minimum tax credit.

State Tax Deductions

Almost every state with an income tax provides a mortgage interest deduction.

Discuss your specific state’s deduction with your tax professional.

So, Is Interest on Home Equity Loans and HELOCs tax-deductible?

In true CPA fashion, the answer is… it depends.

While deductibility is possible under specific conditions, such as using the funds for home improvements on your personal residence, it’s crucial to stay informed about the ever-evolving tax laws.

Consulting with a tax professional is advisable to ensure compliance and maximize potential benefits.

Disclaimer:

The information provided on this blog is for educational and informational purposes only. While every effort has been made to ensure the accuracy and reliability of the content, we do not make any representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information.

Please note that the financial advice and information presented on this blog are not personalized to your specific financial circumstances. It is essential to consult with a qualified professional, such as a financial advisor or accountant, before making any financial decisions or taking any actions based on the information provided here.

We strongly encourage our readers to conduct thorough research and verification independently. The information on this blog should not be considered as financial, investment, or legal advice. Any reliance you place on the information provided is strictly at your own risk.

It is important to understand that any financial product or service mentioned or promoted on this blog may have its own risks and potential drawbacks. We advise our readers to carefully read the terms, conditions, and fine print associated with any product or service before making any investment decisions.